This post originally appeared on the Fraser Institute Blog February 7th. This is the fourth and final post in the series.

In estimating policing needs across Ontario municipalities, one approach is to estimate the determinants of police resources then compute a predicted staffing level. Using the results for the police regression estimated in the third post in this series, we can construct an estimate of police resources per 100,000 for each community based on community characteristics such as available property tax resources, population density and regional variation, and then compare actual staffing with what would be predicted by the regression.

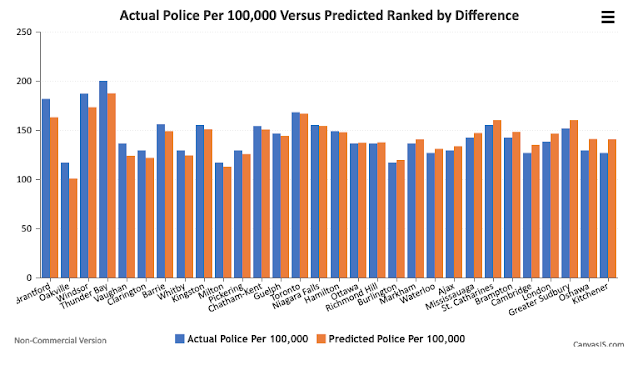

The chart and table below present the results of this exercise and plot the actual number of police per 100,000 versus the predicted for each municipality, and rank the results by the size of the difference between the two amounts.

Brantford has the largest difference with 182 actual officers per 100,000 and a predicted level of 163 resulting, for 19 more officers per 100,000 than the model would predict. It’s followed by Oakville (16 more), Windsor (14 more) and Thunder Bay (13 more). Indeed, of these 30 municipalities, about half have more officers per 100,000 than predicted, ranging from Brantford (19) to Niagara Falls and Hamilton (approximately 1 each). Toronto is also just above its predicted staffing at about one officer more per 100,000 than predicted. The remaining municipalities have staffing below what the model would predict, ranging from about one officer per 100,000 less for Ottawa and Richmond Hill to Oshawa (12) and Kitchener (14).

Of course, these are estimates and there can be other extenuating factors that affect police staffing and hiring in respective municipalities as well as the weight of historical staffing patterns. For example, Windsor is a border city, with cross-border demands and traffic, and an entry point into Canada that requires more policing while Thunder Bay has long-standing issues with high homicide rates, which absorb substantial investigative resources. One also wonders if the presence of casinos in some of these cities may lead to a need for more resources. Moreover, like the rest of the labour force, police forces are aging and some of the proposed hiring may reflect replacements of retirements rather than overall staffing increases.

And for those municipalities that are part of regional police arrangements, the results provide an interesting comparison of what their population sizes suggest their policing resources should be and what they’re getting via a regional arrangement.

For example, Oakville, Burlington and Milton based on the Halton Region staffing all are assigned 117 officers per 100,000 population by the statistics. The predicted staffing per 100,000 is 101 for Oakville, 120 for Burlington and 113 for Milton. Whether this is reflected in actual day-to-day operations or is simply a statistical artefact is an interesting question. It’s also interesting that even though some municipalities are near the bottom in terms of actual police officers per 100,000 population relative to other large Ontario municipalities, they still have more officers than predicted.

However, these results may assist in revisiting the cases of Toronto, Hamilton, Sudbury and Thunder Bay mentioned at the outset of this series. In the case of Toronto, there are long-standing narratives that the police force is either overstaffed or understaffed. Moreover, this debate has occurred against a background of recent rising crime and rising policing costs, more complicated policing needs, issues of racism and defunding, calls for alternate investment in areas like homelessness or mental health, and responses to evolving events such as the recent violence on Toronto public transit. Hamilton has issues similar to Toronto and in the evolving debate over its proposed increases in the policing budget there’s the recent news that Hamilton had a historic drop in homicides in 2022. Does this mean that Hamilton’s police force is so effective that it does not need more officers? Or that Hamilton just got lucky in 2022 and crime rates are more random than one might imagine?

Making resource decisions in a heated, emotionally or politically charged debate environment driven by the events of the moment is not always the best policy approach. While empirical evidence is but one piece of the decision-making process, both Toronto and Hamilton appear to be very close to what the determinants in the models would predict their staffing levels to be, suggesting that other factors notwithstanding, at the very least, better deployment of existing resources may be something worth considering.

Sudbury, on the other hand has eight fewer officers per 100,000 population than the model would predict while Thunder Bay already has 14 more officers per 100,000 than one might expect. A simplistic interpretation of these results given their size would be that Sudbury should go ahead and hire more while Thunder Bay should not. However, if Sudbury is currently able to achieve its policing goals with fewer resources, then it should not automatically feel compelled to ramp them up. As for Thunder Bay, the picture there’s probably more complicated than even a regression equation can possibly imagine, but that still does not mean better deployment of existing resources should not be a complement to whatever else is deemed necessary.

The takeaway from all this is that policing and public safety is complex and complicated and more effort should be made to acquire evidence to support decision-making. The types of results are simply one piece of evidence that can go into resource allocation decisions at budget time, and municipal ratepayers and their city councils should make wise use of all available information. This is especially the case given the large increases in tax rates that seem to be marking municipal budget season in Ontario this year.