The latest report on Canadian house prices by Teranet is out and though the focus is on the 11 largest CMAs, there is also data on smaller centres. On an annual basis (December 2024 to December 2025), home prices in Canada using the Teranet composite Index declined by 3.5 percent. Cities in the GTA and southern Ontario in general saw some large annual declines but some other cities, including Thunder Bay and Sudbury climbed substantially. As the report notes:

“The Teranet-National Bank Composite Home Price Index™ fell by 3.5% between December 2024 and December 2025, a steeper decline than the 2.8% drop seen the previous month. However, increases were recorded in seven of the 11 cities that make up the composite index in December. Quebec City led the way with a 12.6% year-over-year price increase, followed by Edmonton (+5.1%) and Winnipeg (+5.0%). Conversely, the largest declines were observed in Toronto (-7.8%), Hamilton (-7.8%), and Vancouver (-5.9%). Of the 18 other CMAs not included in the composite index, 12 posted annual declines. Among the declining markets, the sharpest decreases were recorded in Oshawa (-8.2%), Guelph (-8.2%) and Kitchener (-8.0%). Conversely, the largest increases were observed in Lethbridge (+10.1%), Thunder Bay (+9.0%) and Sudbury (+8.8%).”

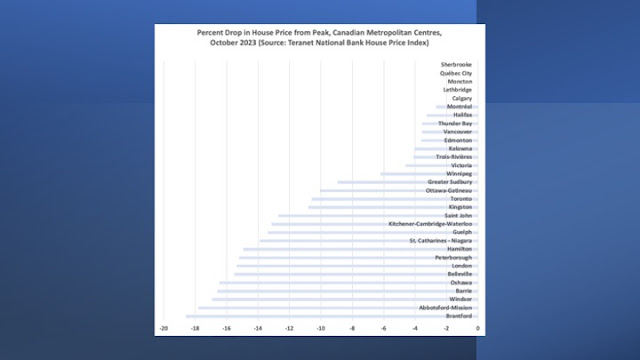

The accompanying figure plots the ranked year over year price increases (December 2024 to December 2025) for the cities in the Teranet data. Topping the rankings are Quebec City and Lethbridge with year over year house price increases of 12.6 and 10.1 percent. Thunder Bay and Sudbury are at the top of these rankings also in 3rd and 4th place respectively with increases of 9.0 and 8.8 percent. Of the ten largest decreases, eight out of the ten largest decreases were cities in Ontario with the other two being in British Columbia.

Overall, the Thunder Bay market is apparently still quite robust. According to the Thunder Bay Real Estate Board, sales of single detached homes in Thunder Bay in December totaled 61 units and overall there were 1,023 home sales in 2025 for an increase of 9.1 percent over 2024. The year-to-date median price for a home in Thunder Bay according to the TBREB was $395,000. As for Sudbury, the Sudbury Real Estate Board saw 110 homes sales in December 2025 and year over year saw sales of 2,618 units for a gain of 2.7 percent from 2024. The average price of a home in Sudbury in 2025 was $505,884 and represented an increase of 5.8 percent from 2024.

If anything, these numbers may give an indication of what cities have been hit the hardest hit by the current economic uncertainty and change. There are 29 cities ranked in the accompanying figure and of those 13 saw an increase in house prices and the remainder a decrease. Of the 16 Canadian cities in this ranking that saw a year over year decline, four of them were in British Columbia and all the rest were in Ontario.