The City of Thunder Bay has released its proposed 2023 budget and it looks like the biggest tax increase in recent years. The proposed budget is increasing the tax levy by 6.18 percent (just under 6 percent after tax base growth) which will raise the total tax levy by nearly 13 million dollars and bring the total tax levy to over 220 million dollars. As the accompanying figure shows, this will be the largest tax increase since at least 2015 and probably since 2006. In terms of tax levy increases for the 1991 to 2023 period, since 1991, Thunder Bay tax levy increases have ranged from a high of almost 22 percent in 1998 to a low of -1.7 percent in 1995. If enacted, this proposed levy increase will be the fifth highest since 1991. The current Mayor campaigned on keeping the tax increase low and reduce bureaucracy but this proposed budget comes apparently with an additional 50 full time equivalent employees. With inflation running at over 6 percent, the proposed budget comes pretty close to the inflation rate which is not unexpected as signals to this effect have been ongoing for months. However, one suspects the Mayor will at least make an effort at vocal displeasure at this increase given that it is the fifth highest increase since 1991, the highest increase in nearly twenty years and he was the mayor from 1997 to 2003 which means he was also in office as the Mayor during the highest levy increase in the 1991 to 2023 period. A legacy associated with some of the highest tax increases in Thunder Bay's municipal fiscal history is not something the mayor probably is interested in. The reaction of the rest of council and the public will be key. These are of course very preliminary numbers and reaction on my part and the full budget has yet to be posted on the city web site at the time of writing but will take a look at the details in coming days.

Northern Economist 2.0

Wednesday 4 January 2023

Friday 14 October 2022

The Next Council: The Challenges for Thunder Bay

Shortly, there will be a municipal election in Thunder Bay with

a new council selected. It is likely

there will be a major change in composition with quite a few new faces and this

will usher in a period of change though perhaps not as much change as one might

expect. In the end, The City of Thunder

Bay is a corporation and what an election does is essentially select its board

of directors who serve as an executive laying out direction with execution and

implementation being the responsibility of the City Administration. Sometimes, the more things change, the more they stay the same.

The City Manager reports to City Council and is responsible for putting into effect the directives of council within the framework of what is allowed by the Province of Ontario. More importantly, the City Manager and Administration possess the information set from which the councillors then make their decision. As well, given their role as full time employees rather than part-time representatives, they have the time to deal with the detail of issues. Inevitably, some councillors will find the level of information and detail overwhelming. The overwhelming complexity of issues in the past has often resulted in meetings where councillors on the advice of administration quickly make decisions on millions of dollars of spending and complicated bylaws with long-term impact while then spending hours debating relatively minor matters involving a few thousand dollars.

There are some departing members of the outgoing council that it will be sad to see go given that among them are the remnants of what passes for a fiscal conservative in Thunder Bay political life these days. Based on a perusal of the candidate slate currently up for election, this is likely to be one of the more activist councils that Thunder Bay has seen in some time and their first test will be the 2023 budget. A relatively new council will be heavily dependent on the advice of administration and also eager to deliver on whatever promises they have made and agendas they campaigned on, and the result will likely be a heftier tax increase than has occurred over the last few years.

The Mayor’s position is essentially one of first among equals despite whatever strong mayor powers are eventually afforded by the provincial government to Thunder Bay. The outgoing Mayor was good for Thunder Bay given he was articulate, well informed and lent a certain dignity and gravitas to the position – though some times while in the midst of yet another marathon Zoom meeting he seemed increasingly exasperated and resembled an artist being forced to work on a much smaller canvas. Such a sentiment is understandable, but the Mayor might have been happier by drawing inspiration from others in Thunder Bay and northern Ontario in a range of positions and occupations who have made a career of working on a smaller canvas.

In the end, the challenges for the next council are many. There is a housing and homelessness crisis in Thunder Bay that parallels that in other cities given the climb in rents and home prices during the course of the pandemic. There is crime – with 12 murders already in 2022, Thunder Bay is well on the road to regaining its title as Canada’s murder city in per capita terms. And of course who can forget infrastructure whether it is roads and sewers or recreational infrastructure given that the Turf facility has reared its head as an issue in the election with some candidates expressing support for the concept but not at the original high cost.

Surprisingly, little mention has been made of the other chaotic infrastructure problem Thunder Bay faced during the pandemic which was the plague of leaky pipes in homes throughout the city in the wake of the sodium hydroxide water supply lead mitigation experiment. Needless to say, the public silence from the outgoing Mayor and council on this issue - no doubt on the legal advice from City Administration and its lawyers given potential costs and legal liabilities - has left a bitter taste for many. So much for a friendly community oriented city with your elected representatives always ready to lend an ear.

And the biggest issue? Well elections are in the end obviously no place for serious long term policy discussions but the fact remains that Thunder Bay’s regional role as a centre for a growing and under counted Indigenous population is the big one. Increasingly Thunder Bay and its municipal ratepayers are paying for regional services on a city tax base. The latest example here is in the case of the Thunder Bay Police Service and the recommended changes that among other things ultimately mean the Police Service has to take a regional lens to its operations.

A move to a more regional approach in policing in the end is a continuation of a trend over the last twenty-five years that can be best described as informal and piecemeal northwestern Ontario regional government by default - a regional hospital service, a district social services board, a district emergency service organization, and regional public utilities such as Synergy North and TBayTel. Indigenous organizations have also established presence in Thunder Bay and Sioux lookout providing regional services to their members. Yet, there was never really any type of democratic regional mandate for this evolution. True, one can always blame the province or Ottawa given that much of this is under provincial or federal jurisdiction but our local municipal leaders to date have ignored the long term picture painted by this evolution. After all, it is a complicated and overwhelming set of circumstances.

Of course the trend to more regional services is also a function of the claim that Thunder Bay has under counted its population and more services need to be provided to service this under counted population. But how can you provide more services if you do not know how many people there are? After all, on the one hand there are claims made by some municipal candidates we are losing people “daily” to other cities but at the same time there are apparently tens of thousands more people here who need services. Which is it? Unfortunately, social surveys based on self-reporting and life stories however compelling and reflective of reality do not a rigorous estimate make.

At minimum you would think we could put an estimate together ourselves based on local and regional electricity use from Synergy, cell phone and phone subscriptions from TBayTel, patient counts (given they have addresses or OHIP cards) from medical facilities in the region, and school enrollments from all the public boards. These should be correlated with population growth and enable an estimate with upper and lower bounds keyed to census benchmarks. In the absence of this, one ultimately has to accept the Census results which do say that according to the 2021 census, the number of Indigenous residents of the Thunder Bay Census Metropolitan Area grew by about 12 per cent between 2016 and 2021, to a total of 17,000 people.

And so, what next? Well, one suspects that after a honey moon period of sunny optimism, it will be business as usual for the next council accompanied with a fairly hefty tax increase. All the candidates acknowledge a lot of issues ranging from roads to crime to homelessness to mental health to opioid addiction. They don’t agree with increasing what taxpayers pay when it comes to revisiting the Turf facility and want to explore alternatives like donations and fundraising but in the end they will solve problems by “taking action” and “working tirelessly” which usually means a tax increase as a starting point under the banner of investing in ourselves and then avoiding constituents when they complain too much.

Nevertheless, hope springs eternal. Maybe this council will be different.

Thursday 23 June 2022

Is There Really a Municipal Candidate Shortage in Thunder Bay?

Outgoing councillor Rebecca Johnson has joined city administrators in raising the alarm over what appears to be the low number of confirmed candidates for this fall’s municipal election. In 2018 there were apparently twice as many registered candidates at this point. On the one hand, this is probably not a surprise given the last few years have been exhausting because of the pandemic not to mention the worst winter in two decades has left people scrambling to repair damage to homes and basements. People are preoccupied on numerous fronts now and running for council is probably not at the top of their list. Moreover, there is still almost two months to go until the August 19th deadline and if the past is any indication, there will be plenty of candidates springing from under the woodwork any day soon.

Of course, given the record low turnout in the recent provincial election, it is a reasonable question to ask if there is a lack of engagement with this year’s coming municipal election. Political life has never been more challenging given the presence of social media which makes election campaigns often more akin to a process of ritualistic character assassination than a debate of ideas. There is probably also a sense of fatigue in Thunder Bay over constant issues that never seem to be resolved and in recent years appear to have only grown whether it is crime or deteriorating infrastructure. One expects this year’s issues will be quite similar to those of 2018 and one senses this endless wheel of time litany is discouraging to many.

And then there is the process of running for municipal office which is not just about signing up to appear on a ballot, but which over time has involved like everything else into a more involved bureaucratic process. Nomination papers must be filed by appointment only. You need the endorsement of at least 25 people if you wish to run for Mayor or councillor – a spur of the moment decision it is not. There is a filing fee, a declaration of qualifications and a consent to release personal information. While one might want to discourage frivolous candidacies, at the same time, one may need to review the process to see if it can be made more candidate friendly.

Yet, it remains that there is probably not going to be a shortage of candidates. This type of hand wringing has happened before and will happen again. During the 2018 municipal election campaign in Thunder Bay, there were similar concerns being expressed by early July as with the exception of the Mayor’s position, there was a drop in the number of candidates seeking municipal office in most of the wards. It turns out after the story went out, a slew of candidates came forth and the total number of candidates running for municipal office in Thunder Bay rivalled that of much larger cities. There were 101 candidates vying for office of 2018 with 26 going after an at-large position which pretty much guaranteed victory for incumbents.

In the end, the chief beneficiary of a plethora of candidates is incumbents who already have deep rooted name recognition. More candidates split and fracture any opposition vote whereas fewer candidates running allows dissenting or dissatisfied voters an opportunity to coalesce around an opponent and bring incumbents down. It is noteworthy that many incumbents have not declared yet either – including the current Mayor. Incumbents announcing too early potentially scares off candidates and reduces the candidate pool, so the trick is to lay low and wait for the competition to reveal itself in sufficiently large numbers and then emerge. One suspects the same is going to happen yet again and by August we will be lamenting that there are too many candidates, and the same faces will be getting in again. Thunder Bay’s wheel of time continues.

Wednesday 8 June 2022

Rising Surpluses, The Other Shoe Drops...and Manure

Well, the City of Thunder Bay’s finances just keep getting better. After projecting a positive variance of $3 million for the 2021 budget year, and then a surplus for 2021 that was supposed to be coming in at $5.6 million, the 2021 surplus has now come in at $10.9 million. Thunder Bay will have its seventh consecutive positive budget variance making for accumulated variances of $31.3 million over seven years. Indeed, this is the largest surplus in seven years. While much of the savings will come from lower-than-expected COVID costs for which the city has received substantial federal and provincial support, it remains that the City of Thunder Bay could obviously use some some help in crafting their budget projection and forecast models.

Figure 1 plots the annual tax levy increase since 2015 against

the corresponding surplus at year end.

For example, in 2015, the tax levy increase was $9.4 million – a 5.7

percent increase on a $164.7 million levy the year previous. The year’s end saw

a positive variance of about $1 million which on $174 million tax levy was just

over one-half of one percent. Since

2015, however the size of the surplus has increased substantially, often coming

close to matching the size of the tax levy increase that year. In 2017 for example, the levy increase was

$5.96 million – a 3.3 percent increase – but the year-end surplus came in at

$5.6 million – almost 95 percent of the value of the original levy. For 2021, there

is now a surplus of $10.9 million – which is more than double the original tax levy

increase of $4.3 million. This is indeed

a first, a surplus bigger than the year's tax levy increase. I suppose if they had some creative economists working for them, the City of Thunder Bay could spin this as a tax levy surplus multiplier of 2.53.

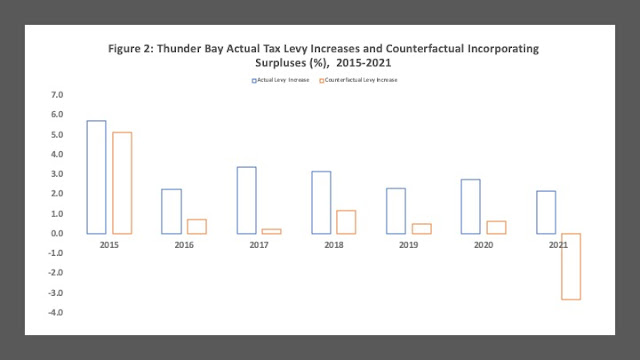

If Thunder Bay had been able to correctly forecast the surplus each year and implement a tax increase incorporating the surplus and balancing the budget, what could have the alternate tax levy increase have been? Figure 2 plots the actual percentage tax levy increase since 2015 and the alternate increases. In 2017, for example, the budget could have been balanced with an increase of 0.2 percent but instead there was an increase of 3.3 percent. The year 2020 saw an increase of 2.7 percent but all that was needed is an increase of 0.6 percent. Meanwhile, the surplus for 2022 means that rather than a 2.1 percent levy increase, there could have been a levy reduction of 3.3 percent.

Outrageous? Not so much as the other shoe that has dropped in the face of growing surpluses - a hefty pay increase for some City Managers. Some managers this year will see raises as high as 12 percent with the range for 319 management and non-union staff ranging from 4 to 12 percent this year. Given the stress of managing city services during a pandemic, one can certainly understand the need for raises. At the same time, there have been a lot of stressed-out public-sector employees in health and education and guess what? The provincial government held them at one percent a year for the last three years. What should we think of all this during a municipal election year? Well, here is another great juxtaposition – the City of Thunder Bay is offering free compost to residents while quantities last with a half-ton load limit per person. With a $10.9 million dollar surplus, one would think the supply of compost would be endless. They really have stepped into it this time.

Thursday 30 September 2021

Does Thunder Bay Need More Police Officers or Redeployment?

The Thunder Bay Police Services Board (TBPSB) in response to a resolution tabled at a recent City council meeting by Mayor Mauro has asked the police service to “produce a report on a possible redeployment of existing resources to get more officers on the front line.” The mayor was motivated to make the request based on feedback from residents who have been complaining about crime in the city.

The police in Thunder Bay appear to be facing increasing service calls on a variety of fronts while crime rates in the city along with homicide rates are not exactly in the middle of the distribution when it comes to comparably sized CMAs across the country. Meanwhile, an additional half a dozen officers have been hired since 2018 so the mayor wants to increase front-line deployment of officers. However, apparently the TBPSB annual report for 2019 does not specify how many of its 227 officers are considered front line – hence the request.

In the absence of direct information, we are left with comparisons and assessments based on the data available. A question one can ask is how does Thunder Bay’s policing strength per capita look compared to other cities? The accompanying chart using data from Statistics Canada provides police officers per 100,000 population for a dozen Ontario cities including the five northern Ontario cities. The numbers are for 2000 and 2019. Except for Toronto and Peterborough-Lakefield, since 2000, all of the cities have seen an increase in police officers per 100,000. In percentage terms the largest increases have been for Barrie at 38 percent followed by Timmins at 28 percent, then Kingston at 23 percent and Thunder Bay at 18 percent.

Of the five northern Ontario cities, Thunder Bay in 2019 had the most officers per 100,000 population coming in at 205. This is followed closely by Timmins at 199 and then the Sault at 177, North Bay at 160 and then Greater Sudbury at 155. Of the southern Ontario cities, Windsor comes in at the top at 205 per 100,000 followed by Barrie at 163 and Toronto at 162. The average number of police officers per 100,000 is generally greater in the five northern Ontario cities at 179 compared to the seven southern one here at 159. That staffing requirements might be larger in the north given the geographic spread of its major municipalities as well as unique local issues is not in question. In the south, Windsor is also an outlier and can probably base its numbers on the unique challenges of being a border city.

Nevertheless, in per capita terms, Thunder Bay is at the top of the distribution whether it is being compared to its northern counterparts or others in the rest of the province. The mayor is correct in asking whether there is potential for redeployment of existing police resources to the front line especially given the increases of recent years.

Wednesday 3 March 2021

Building a New Vision for Thunder Bay

Pandemics are ultimately associated with great economic and social change as once the pandemic subsides, there is never a full return to the previous world. In Thunder Bay, the changes wrought by the pandemic have emphasized and highlighted many of the city’s problems. Along with continuing high rates of crime, homelessness, racism, mental illness, and the growing effects of a changing climate, the lineups at food banks have been increasing and there even seems to be a return to a wild west frontier mentality with increasing numbers of people being stopped by police for driving under the influence. Thunder Bay has always been a city with a mean frontier edge to it whether it is on the city’s roads, its bars, or its school parks and playgrounds.

The recent surge in COVID-19 cases particularly in lower income homeless residents accentuates the reality that there are really two Thunder Bays – a Thunder Bay of growing poverty as employment and health becomes more precarious given job loss and city businesses hard hit by the pandemic and one of secure largely broader public sector driven employment. The evidence of the social and economic changes that have emerged over time are there for all to see - if they want to.

Figure 1 shows that the decline in homicide rates in Thunder Bay that had been occurring in tandem with the rest of the country came to an end circa 2007 – perhaps not entirely coincidentally at the tail end of the massive economic shakeup of the regional forest sector crisis. They have since been rising and Thunder Bay invariably emerges year after year as the murder capital of the country. Figure 2 shows that over the last decade, overall building permit values – which signal new investment – have trended downwards and residential permit values have been largely stagnant. Figure 3 shows that housing starts have essentially been flat at low levels compared to the pre-1990 period. Figure 4 shows that over the last 20 years, employment has trended downward with the pandemic providing the expected additional downward spike at the end of the series.

Over the longer term of its economic history, as captured by the evolving population size shown in Figure 5, Thunder Bay has essentially been stationary since the 1970s. That is important because population still is an important economic indicator in that population growth tends to respond to economic opportunity and Thunder Bay’s lack of population growth is the one long-term indicator of the state of its economy. Our city’s population peaks in the late 1970s and 1980s and has actually trended slightly downward since. One wonders about the coincidence between the end of growth in the 1970s and the onset of a monopoly municipal government in place of the formerly competitive municipalities of Fort William and Port Arthur.

It is true that the Thunder Bay CMA population is larger at about 125,000 or more and has actually trended slightly upwards in recent years. However, it is the official population of the City of Thunder Bay within its city boundaries and not the CMA population and residents external to Thunder Bay city proper that matter because in the end it is the tax base of the City of Thunder Bay that pays for services in the city via the tax levy. Yet, what is quite remarkable is that despite the lackluster growth in major indicators, there has been substantial growth in the tax levy of the City of Thunder Bay and associated municipal employment as Figures 6 and 7 demonstrate. While the rate of growth of the tax levy has declined over the last five years, it has grown faster than both population and inflation combined.

All this coincides with the growing disquiet many residents feel with respect to the direction the City has been taking. Yet, in the face of mounting evidence of substantial issues there seems to be an increasing sense of detachment from the public by the Mayor, City Councillors and Administrators given recent decisions such as the pursuit of expensive major capital projects like the proposed new Indoor Turf and police facilities, the silence on the epidemic of home plumbing issues linked to City water, and a pathological preoccupation with seemingly superficial issues like tourism signs and sporting events. True, our city councillors are always quick to articulate their concerns about the problems facing Thunder Bay and indeed much of their meetings are taken up by pious words too numerous to count but in the end, they are either unable or unwilling to systematically tackle the future.

A key part of the problem is that our patterns of civic decision making are rooted in a mid-twentieth century vision of where Thunder Bay needs to go. My take on that vision – which I articulated in an earlier post – bears repeating and can be summarized as follows: Thunder Bay is a regional center and strategically located full-service high-tech urban oasis set in a pristine natural wonderland with a wonderful quality of life on crucial east-west trade and transport routes whose full potential is unrealized. Indeed, the entire City’s potential is unrealized and what Thunder Bay needs is continual infrastructure investment to attract people and effective communication of our potential to convey the message of how wonderful we are. While Thunder Bay may have social problems, they are not any worse than other places and have been blown out of proportion by the national media. City residents need to have a positive attitude, stay the course on this strategy, and we need to invest in the public services and infrastructure to make it all happen.

This is in essence what continues to drive civic policy in Thunder Bay even though since amalgamation in 1970 the City has stayed static in population, its industrial mainstays have largely disappeared, and its grain transportation role shrunk to a shadow of its former glory. While there indeed has been some employment diversification into a knowledge economy and the health and education sectors that have helped provide a market and business opportunities for some entrepreneurs, it remains that this has been largely a rear-guard maintenance action that has barely kept pace with the employment losses. Moreover, much of this employment growth has been in broader public sector employment making it increasingly tied to political decision making in Toronto or Ottawa. Our political clout is not as large as we like to think given the higher population growth in southern Ontario.

Key to this local vision is the level of municipal spending, employment and infrastructure investment partly geared towards keeping the economy going via construction projects. This spending is financed by government grants and by tax increases levied increasingly on the residential tax base given the departure of the industrial mainstays who provided the base for the past development of a very generous level of municipal spending and programs. Tax increases are justified by “a build it and they will come philosophy” but it has become apparent that after fifty years we have built a lot and not too many have joined us. When the point on practically zero population growth is mentioned, the response is that we have large numbers of temporary residents whether they be students or visitors from outlying First Nations requiring services. However, we do not seem to have accurate numbers documenting this aside from the ones City Councillors and Administrators like to throw out - numbers like “20,000 or 30,000 more” during meetings without supporting empirical evidence. More to the point, there is the question as to why municipal ratepayers should even be providing these additional services out of a local property tax base? Where are the provincial or federal governments in all of this? Indeed, in the wake of rising cases recently, the pandemic has revealed just how truly stretched our resources are given that Thunder Bay is serving as a regional health and social service support center on a city budget.

We have an expensive vision of local and regional municipal government spending based on an economic base that no longer exists. That vision is justified by a “build it and they will come philosophy” that continues after waiting 50 years for results. Thunder Bay continues to invest and prepare for the next boom and yet that boom never comes or is much more subdued than expected. Even the most recent mining strategy released by the city’s Community Economic Development Commission continues in this tradition by documenting the prospects of 7,000 jobs over the next decade - nearly a decade after the prospects for the Ring of Fire’s mining boom were first pronounced.

When the Mayor and Council are criticized, their rebuttal takes the form of dubious arguments such as the need to invest today for tomorrow and how we need to invest in our quality of life. Who can argue with quality of life or renewal of aging infrastructure? Yet, it turns out that much of this money is being spent on just two things – administration and protection. We have one of the highest per capita tax levies of major cities in the province and spend the highest per capita amount of 27 major Ontario municipalities on administration, police and fire while managing to be one of the lowest spenders on the remainder. The need for a re-balancing of spending priorities is obvious.

Taxes and fees go up but that is justified by our civic leaders as all right because our cost of living and property values are lower thereby resulting in lower taxes relative to bigger cities with more expensive housing meaning they can be raised more because they are a bargain compared to Toronto. This is debatable but not the main point. If the cost of living here was truly lower resulting in a surplus for local residents in excess of what they need, why we might not want to keep money in our own pockets rather than simply hand it over to the local municipal-protection-administrative-construction complex is a question that Thunder Bay politicians do not want to answer.

What is to be done? The mindset and vision that has permeated our local municipal political and economic decision-making culture needs to change. That is more difficult than you can imagine given how entrenched the current vision has become and the short-term municipal political and bureaucratic interests tied to specific projects and expenditures. It is beyond the abilities of any one individual to change an entire municipal tax and spending culture but change needs to start somewhere. It probably also is more than just a municipal culture vision as in the end the outlook of the entire community has been permeated by the current mindset. It is also a new community vision of what Thunder Bay ultimately can or cannot be and do.

Changing Thunder Bay’s municipal tax and spending culture requires four steps. First, there needs to be a recognition that there is indeed a problem and we are a long way away from that given the substance of debate at City Council. Second, once the problem is recognized, there needs to be a meaningful reorientation of priorities. The current expenditure review process is insufficient because it merely presents a smorgasbord of specific tasks and projects to horse trade over given that administrators and councillors look at parts rather than the whole system. The reorientation needs to be at a broader level. Third, in keeping with the reorientation of priorities, it needs to be followed by a major reorganization of services. Fourth, this should then lead to renewal – a renewal of the local municipal and community vision affecting taxes and expenditures and ultimately the quality of life in Thunder Bay.

In the end, the new vision must be one that acknowledges that we need to live within the economic limits of how the Thunder Bay economy has evolved and the fiscal resources available. Within this new limited resource base, there needs to be a shift in priorities away from the current big-ticket items of protection and administration and towards the social and environmental needs of Thunder Bay’s citizens and their growing diversity. It will be a big change and it requires leaders with a municipal and regional vision that goes beyond short-term spending to create short-term employment projects in the hopes that we can buy time until the next boom comes. After 50 years of treading water, it is time to swim in a new direction.

Sunday 7 February 2021

Municipal Budgets, Facts, Debates and Bullying

The 2021 Thunder Bay City budget should finally be ratified this week and getting there has been an interesting process on a number of fronts. First, is the sudden epiphany that struck city administrators by the fall that business as usual tax levy increases in the 3-4 percent range were not going to work this year given the push back from both business and residential ratepayers. Second is the rather assertive tone of debate adopted by some councilors in response to presentations and discussion during the budget process.

With respect to the actual budget, the initial 2021 budget request came in with a proposed tax levy increase of just over 2 percent. However, rather than go up from there, which has often been the case in past budget seasons, councilors have managed to whittle it down slightly to 1.83 percent. Ratepayers in Thunder Bay however should not relax and assume this is a new era whereby the City of Thunder Bay has finally realized its limitations and will begin a new transformative vision of more sustainable municipal government. Rather, one suspects the long game of the part of Administration is still that this is a short-term one-off event and next year with the pandemic subsiding, it will be time for larger tax increases to recover lost ground. This will be a mistake given that Thunder Bay needs to engage in a major exercise to bring its costs especially for government administrative services and protection more in line with other jurisdictions.

As for the tone of debate, well here we were treated to the spectacle of one councilor effectively interrupting a presentation to vigorously challenge debate the presenter’s facts and opinions rather than ask questions in a manner more akin to a court proceeding rather than a council meeting. In response to the presenter’s call for a review of police service spending which has accounted for half the tax levy increase since 2018, the councilor in question countered with the immense workload of the Thunder Bay police service in that it had responded to 5,000 incidents which “in his mind” equaled the amount that Toronto officers attended.

This in itself was an interesting empirical point given the data for 2019 comparing total criminal code violations excluding traffic reported in Toronto and Thunder Bay provided below in Figure 1. Needless to say, the total volume of incidents in Toronto vastly exceeds Thunder Bay. However, perhaps the councilor in question was being more nuanced and meant incidents per 100,000 population in which case Thunder Bay comes in at 7,046 and Toronto at 3,471 – at double the rate. In either case, where the number 5,000 came from and what it really means is probably best answered by the councilor.

However, if the councilor was trying to make

a case supporting the police service, he was certainly not doing them any

favors in his presentation of the data and facts. If one can be permitted yet another colorful marine metaphor, In launching argumentative torpedoes at presenters, the inability of councilors to effectively target and launch runs the risk of sinking their own ship. While one may think they are conducting an in-depth analysis while floundering under the water, it is probably wiser to begin from well above the surface and first survey the potential hazards.

More serious however was the debating of the presenter rather than simply asking questions and what in essence amounted to a form of bullying and badgering the presenter. Needless to say, this did not go unnoticed by several other councilors and to their credit they did attempt to rein the offending councilor in. Needless to say, the presenters provide input and answer questions to provide clarification and it is the councilors who are then supposed to debate the evidence amongst themselves rather than engage in self-congratulatory speeches and grandstanding.

This is not just a Thunder Bay phenomenon at the municipal level. City councilors and administration in Hamilton, Ontario for example are developing a reputation for being rather pugnacious towards their ratepayers and have been called out for hostile attitudes towards residents appearing before council. In Hamilton, there is a proposal supported by legal advice from their lawyers and administration to ban public letters critical of city council behavior from the public record of their meetings. This has prompted concerns that councilors in Hamilton may be trying to shield themselves from criticism.

Of course, in Thunder Bay, the response to criticism or questions on some matters - such as the leaky pipe sodium hydroxide fiasco – is simply to hide behind their lawyers and not answer questions. It would appear that in both Hamilton and Thunder Bay, lawyers appear to be hard at work in making sure there is less democracy. Coming on the heels of pandemic lock downs and social distancing that reduce personal and direct access to your representatives, it would appear we have entered a new era of government dictates from on high. And one gets the impression that many politicians do not seem to mind.

Saturday 12 September 2020

Thinking Big in Thunder Bay

Thunder Bay City’s Council’s agenda for September 14th based on the available documentation has quite a few items that one imagines will have cost implications for Thunder Bay though the full documentation as of Saturday morning seems a bit light on the City website. The usual tomes of several hundred pages seem to be absent but perhaps they will be posted later. Nevertheless, from the very brief documents available, some of the issues: Traffic Signal Review, Boulevard Lake Cleanup & Dredging, Police Facility Needs Assessment Update, Solid Waste Management Strategy Update, Homemakers Program, and a Transit Service Update. There is even an eye on the future employment of our municipal councillors with a report on Municipal election readiness for 2022. However, the issue that will probably chew up the most time is this:

Permanent Thunder Bay Word Sign

Memorandum from Councillor S. Ch'ng dated August 18, 2020 containing a motion recommending the design and installation of a Permanent “Thunder Bay” Word Sign at the waterfront.

(Pages 74 – 75)

With respect to the memorandum from Councillor S. Ch’ng dated August 18, 2020, we recommend the design and installation of a Permanent “Thunder Bay” Word Sign at the waterfront;

AND THAT up to $100,000 of funding be approved through the City’s unallocated Municipal Accommodation Tax funds for the design and installation of the Permanent “Thunder Bay” Word Sign;

AND THAT any necessary by-laws be presented to City Council for ratification.

The Northwood councillor wants to design and build a sign,

similar to ones seen in cities around the world, including Toronto. This has

already received some local

media attention and of course many comments and a TBNewswatch

poll that suggests the idea is almost as popular as going ahead full bore with the

Turf Facility was.

Predictably, there has been a focus on the cost which at $100,000 has struck many as excessive but then our councillors will likely consider it a bargain given that replacing a similar sign in Toronto in front of their city hall with permanent new letters will cost $760,000. At $100,000, Thunder Bay’s sign will only cost $10,000 per letter while Toronto’s will come in at $108,571.43 per letter. Needless to say, our more mathematically inclined councillors will fall over themselves with long speeches on how much more efficient we are and the alphabetical value of money.

However, Thunder Bay likes to think big. Indeed, for $760,000, never mind a small piddly Toronto style sign – with that kind of money one could create a giant white letter Hollywood type sign on top of the Sleeping Giant in our harbour! Or perhaps, we could have a Mount Rushmore type set of carvings of all the members of our current City Council preserved forever in a pose of distant thoughtful gazes with a giant inscription below stating: “They came, they saw, they spent!” Truly, this will be another opportunity for all of us to think big and achieve Toronto style ambition at Thunder Bay prices.

If members of council are inclined towards frugality, I would suggest that the letters of the proposed Thunder Bay Sign be made from the creative intertwining of all the surplus copper piping and water connection lines that seems to dot the lawns in so many of our neighborhoods these days. Not only would this be very artistic and creative, but cost-effective and also an example of wise environmental stewardship as it involves a major effort at recycling. Advertising is all about messages and this would send the message that in Thunder Bay, we recycle more than ideas.

Thursday 23 July 2020

Should the Turf Facility Be Turfed?