In municipalities across Ontario, it is budget season and the GTHA is no exception with the City of Toronto the latest to unveil its proposed 2026 budget. The Toronto Budget unveiled today proposed a 2.2 percent residential tax hike which the lowest property tax increase since 2020 and down from the 6.9 percent increase last year and the 9.5 percent increase the year previous. Needless to say, it must be a municipal election year given the moderation in taxation that is marking this year’s Toronto budget season. Down the lake in Hamilton, the election is also weighing heavily on the Mayor and Council given early intimations of increases over 8 percent in September are now replaced with a proposed tax increase of 4.25 percent which is also lower than the increases of the last two years which were 5.6 percent in 2025 and 5.8 percent in 2024.

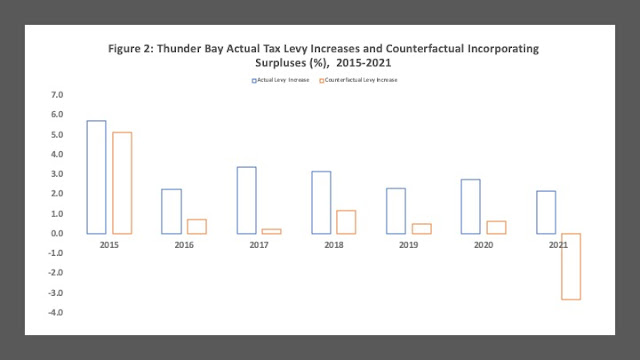

Of course, a longer-term perspective is also useful in looking at the evolution of municipal taxation in these two largest GTHA municipalities. Figures 1 to 3 provide several municipal taxation comparisons of Toronto and Hamilton and as an added bonus Thunder Bay is thrown in simply to illustrate how we stack up with the largest centers in the GTHA. Figure 1 constructs an index of the total tax levy from 2000 to the proposed 2026 budget estimates with the year 2000 set equal to 100. Figure 2 does the tax levy in nominal per capita dollars. Figure 3 presents the annual percent growth rates in the total tax levy. The data is mainly from the Financial Information Returns with the last few years based on currently available budget data.

Figure 1 shows the tax levy index pretty much rising about the same for all three municipalities. Between 2000 and the 2026 budget estimate, the total tax levy in Toronto will have grown 150 percent while Hamilton’s will have grown 174 percent while Thunder Bay’s somewhat more middling at 168 percent growth. Figure 2 converts the tax levy into a somewhat more personal measure by dividing the municipal population into the levy for an estimate of the tax levy per capita. In dollars per capita, Toronto’s tax levy exceeded that of Hamilton or Thunder Bay from 2000 to about 2005. From 2005 to 2010, all three municipalities had pretty much identical per capita tax levies, but divergence has occurred since then fueled mainly by the more rapid population growth in the GTHA. From 2000 to 2025, Toronto’s municipal population grew almost 40 percent, Hamilton’s 34 percent and Thunder Bay’s 3 percent. By 2026, it is estimated that the per capita municipal tax levy in Thunder Bay will be at $2,148 per capita, followed by Hamilton at $2,060 and Toronto at $1,852.

Finally, Figure 3 plots the annual growth rates in the tax levy and again, they all move approximately in tandem. Over the entire 2001 to 2026 period, the average tax levy increase in Toronto was 3.6 percent, Hamilton was 4 percent and Thunder Bay 3.9 percent. However, since 2020, Thunder Bay has averaged 3.8 percent compared to an average of 5.1 percent for both Toronto and Hamilton.

On average, the increases in the tax levy have been fairly similar over the last 20 years which is to be expected given these are all municipalities in Ontario and subject to similar rules and financial pressures from the provincial government. At the same time, their economies and population growth rates have differed substantially making for differences when tax levies are adjusted for population growth.