Many will have caught Alex Usher’s post on HESA dealing with

university finances in Canada during

the pandemic year which paints a surprisingly different picture of university

finances than what one might expect. Of the

34 universities with data available for the 2020-21 fiscal year, 30 of them

posted surpluses and some of them were quite staggering. For example, a 726 million-dollar surplus at

University of Toronto (a $441 million surplus the year previous) or Queen’s

with $144 million surplus (year previous was $35.7 million). This seems quite at odds with the sky is

falling scenarios that propagated the early part of the pandemic as

universities argued that they were going to lose money. So how did this happen?

According to Usher: “Well, apart from the University of

Saskatchewan (where the turnaround was mostly due to a quite amazing uptick in

the investment portfolio), the formula was pretty simple. Overall, university revenues rose slightly –

about 2.6% in nominal terms – while expenditures stayed unchanged. Essentially, the savings from keeping

campuses closed offset the usual 2-3% growth in salary costs.” Indeed, as he concludes: “universities did

not in fact lose money during the pandemic.

They cut their budgets in anticipation of a fall in revenue and then the

fall never came. They will be in good

shape to deal with the next year or two when, I suspect, we will see a bit more

labour militancy that we’ve seen for awhile.”

So of course, the interesting question is how did Lakehead

University do? Well, Lakehead has also

done surprisingly well according to its 2020-2021

financial statement that was recently released. From 2020 to 2021, revenues

did fall slightly from $200.2 million to $198.3 million – a drop of just under

one percent. However, total expenses

fell even faster going from $198.7 million in 2020 to $187.6 million in 2021 –

a drop of 5.5 percent. As a result,

there was an operating surplus of $10.691 million in 2021 which was up from a

surplus of $$1.542 million in 2020. And

this was before the unrealized gains from an interest rate swap are factored in

which brings the total surplus to $14.456 million. It turns out Lakehead, like Saskatchewan, did

very well on its investment portfolio seeing an increase in investment income

from $3.4 million the year before to $20.055 million – a staggering 488

percent. One wonders why their

management of their own investment portfolio does not translate into better

management of the university pension plan – one of the worst university pensions

in the country in terms of the benefits provided to retirees but I digress.

On the revenue side, aside from investment returns it turns

out everything else was down. Government

general grant revenue was down 3 percent while student fees were down 1.5

percent. There was a slight fall in

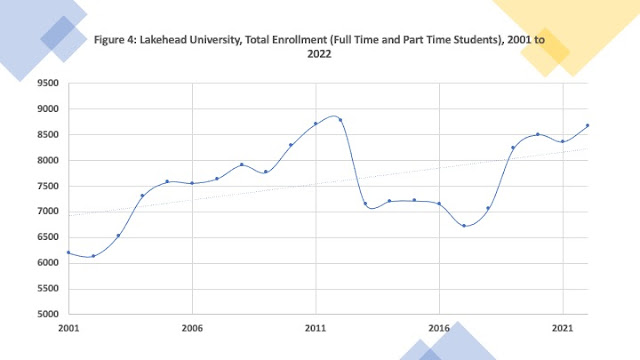

enrollment which accounts for this as total enrollment (full-time and part-time

students) went from 8505 to 8365 – a decline of 1.6 percent. However, the good news is that 2021-22 is

expected to see a rebound with total enrollment currently estimated at about 8668

– an increase of about 3.6 percent. So,

one can expect both tuition and grant revenue to rebound this year.

As for expenses, well salaries and benefits were down -0.3

percent, supplies for operations were -25 percent, the costs of operating

assorted sales and services were -61 percent, building and equipment maintenance

costs were -19 percent and travel was down a remarkable 93 percent – from $4.1

million the year before to $302 thousand during the pandemic year. This may prove to be one of the more important

cost savings as the constant shuttling of administrators and staff from Thunder

Bay to Orillia and Toronto obviously can be replaced by Zoom technology. As for salaries and benefits, the university

took full advantage of the provincial restraint salary guidelines thereby

keeping compensation cost growth low and that will continue this year given the

contract that was negotiated. And, it

turns out that having all the faculty and staff work from home saved several

million dollars in operations and maintenance as costs like utilities were shifted onto employee home budgets.

So, in the end the sky did not fall and when the last year

is placed in long-term context, Lakehead’s finances are indeed looking quite

robust. Figure 1 plots revenues, expenditures,

and deficits since 2000 and they show growing revenues and expenditures and

deficits in only 5 of the last 21 years. The last five years have seen a string

of operating surpluses of which 2020-21 is the largest. Indeed, Lakehead has

seen an accumulated surplus since 2020 of $83 million dollars. Where has that money gone? Likely into the

university’s long-term investment portfolio which according to the financial statement

sits at about $144 million dollars and of course this year earned a whopping

$20 million dollar return. It certainly

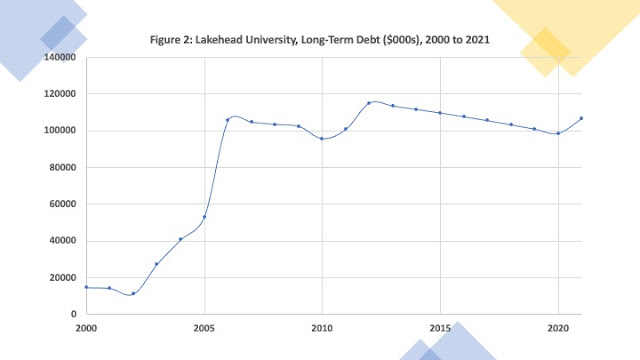

has not gone into paying down the debt which as Figure 2 shows went up $8.038 million

in 2020-21 from th year previous to reach $106.6 billion. This was to finance the athletic facility expansion.

When it comes to long-term major revenue performance as

depicted in Figure 3, government grants in total dollars have been flat at

about $65 million annually since 2010 and as a share of total revenue have

declined from a peak of 43 percent in 2009 to reach 32 percent at present. As for student fees (tuition), it has grown

dramatically since 2010 –nearly doubling from about $43 million in 2010 to

reach $84 million at present. Figure 4

shows that enrollment growth is only partially responsible for this because despite

the long-term upward trend, total enrollment is about where it was a decade ago

and has been recovering after a decline.

What has changed is the composition of the students as there has been a

larger share of international; students who also pay much higher tuition.

So, there you have it.

Lakehead’s finances during the pandemic were quite good and come on top

of a long-term stable and improving financial situation marked by rising

revenues, enrollment growth and an expanding university investment

portfolio. This echoes the comments made by the university during the situation at Laurentian that Lakehead is "very financially sound". That is good to know. If Alex Usher is right,

Lakehead like the rest of the university sector will see increasing calls from

its faculty and staff for a return on their investment of time and personal

resources into the operations and success of the university.