Thunder Bay has released its planned 2026 operating budget and as usual there are a plethora of numbers, facts and figures splashed across our local media. This year’s budget is especially interesting given that in the lead up to its release, the messaging from The City was that the tax levy increase would be held to 2.6 percent. However, as it has emerged, this initially did not consider the rather large request from the Police Services Board of a 9.1 percent increase for their requirements as well as larger requests from other external boards. Apparently, those are 'external' and the City itself has done a good job of keeping its increases to 2.6 percent though one should add City Council needs to approve all of these increases if they are to go forward.

Given that police services alone account for 22 percent of the property tax levy, this has bumped up the proposed municipal levy increase to 4.4 percent though the City as usual is doing its after growth schtick and saying it is only 4 percent. With the Growth Plan setting 3 percent in the assessment growth as a target, we can joyfully anticipate the day when there will be a 4 percent levy increase but which only amounts to 1 percent after growth. And as usual, one also needs to factor in the rate-supported budget in all of this. The average residential household will see a 4.1 percent increase in their total Water and Wastewater charges bring the average per household up to $1,479.88 from $1,436.84. As a further note, The City will also be expanding its employment in 2026 adding 57.1 Full Time Equivalent positions in areas such as safety and security, growth, service delivery and to run the 2026 municipal election.

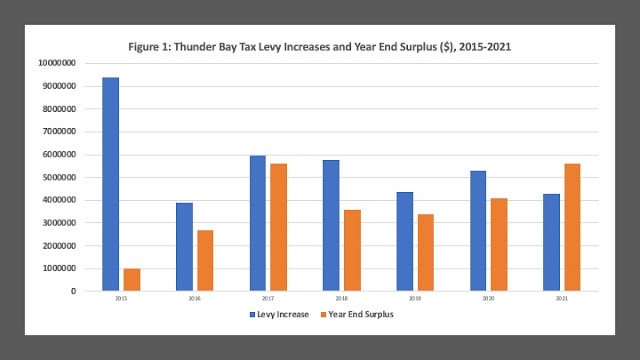

As has been my practice, the accompanying figure plots Thunder Bay’s tax levy increases since 1990 to provide context. The last four years have seen a distinct increase in the tax levy not only from the lows of the pandemic but from the period immediately pre-pandemic. Over the 2023 to 2026 period, the levy increases average 4.7 percent putting this year’s increase slightly below the four-year average but well above the 2015 to 2022 period average of 3 percent.

Of course, the budget still must be ratified and there is a period of public input but the current Thunder Bay City Council is not likely to push back much against what is being asked for even if public opposition emerges given their performance last week largely endorsing the sale of public properties and development as proposed to build new density housing projects in established neighbourhoods. On the other hand, the debate will be interesting to monitor to see what finally emerges given that we are going into an municipal election year.