Thunder Bay has signaled that it wishes to increase urban density by enacting a new zoning bylaw in April of 2022 designed to encourage urban density through a process of infill. One of the more controversial changes is that the urban low rise neighborhood designation now permits buildings that can contain one to four homes based on the size of the property. Most buildings in such neighborhoods can now be permitted to contain two homes – mainly basement apartments or “mother-in-law” suites but backyard homes will also be allowed. In some respects, this legitimates a process that has already been underway in many neighborhoods given the persistent housing shortage that seems to be present even in Thunder Bay - a city whose official population has not grown that much since 1971. And as part of the move to create new housing and urban density, there is now a move underway to consider reviewing surplus City of Thunder Bay land for the purposes of selling it for infill housing. Of course, there is the usual inconsistency in that while wanting to increase density in existing residential neighborhoods, Thunder Bay is expanding standard suburban developments at the same time which often reduce urban density.

Ultimately, the policy of allowing more units on a standard-lot or the renting of basement apartments is really an infill policy done on the cheap by piling more people onto existing infrastructure and services and not worrying too much about any disruption or other social costs. In addition, more people living in current suburban residential areas removed from shops and services simply perpetuates a car intensive community. True density housing should be built adjacent to or in the two main downtown cores with secondary core density areas being areas like perhaps Westfort or the Bay-Algoma area. True density housing is not a single detached home or duplex that accommodates renters on an existing lot in River Terrace or Vickers Park, it is two and three-bedroom apartments in 4 to 6 story buildings and sometimes even higher, situated adjacent to core areas with a lot of shops and services. In this regard, even parts of intercity near shopping malls could be considered a location for an apartment building or condo though the swampy nature of the area probably militates against high rise construction. If the city has surplus land and buildings in these core areas, that is what should be used to stimulate density.

And of course, just selling land and hoping that if you sell it, they will build, is ultimately not enough. You probably need to streamline the permit and approval process as well as rebate those costs with the amount of the rebate tied to the speed with which the building is constructed and put on the market. In addition, you probably need to lower the property tax rate on such structures to make them more lucrative for developers to build density buildings. This is a key point and a neglected one. To start, take a look at figures 1 and 2. Figure 1 plots population density as a proxy for urban density in Ontario’s thirty largest municipalities and Thunder Bay ranks fifth from the bottom. Figure 2 takes those same municipalities and plots their multi-residential total property tax rate from highest to lowest.

It turns out that Thunder Bay has the third highest multi-residential rate – just after Chatham-Kent and Windsor. According to the 2022 BMA Municipal Report analysis, the average multi-residential rate in Ontario communities was 2.04% but in Thunder Bay it was 3.12%. Other examples include Brampton 1.56%, Hamilton, 2.73 percent, Burlington 1.45%, Sault Ste Marie 1.77%, Greater Sudbury 2.98%, and Guelph, 1.99%. Elliot Lake is higher at 4.0%, Belleville at 3.24%, Port Colborne at 3.45%, and Timmins at 3.35%. My point is larger cities - of which Thunder Bay is still considered one - tend to have lower rates but Thunder Bay taxes its multi-residential more like a much smaller town. Why is Thunder Bay so spread out? True density is penalized by its property tax structure.

Now it should be noted that a high multi-residential property tax rate in and of itself is not evidence that it is discouraging density development. In general, municipalities with weaker tax bases tend to have higher rates in general to provide the same range of services often mandated by the provincial government. In this respect, Thunder Bay is in good company with other cities whose former lucrative industrial tax base has seen decline – Windsor, Sudbury, Hamilton, and St. Catharines. Thunder Bay just has high rates in general and it also has the third highest residential tax rates of these thirty municipalities.

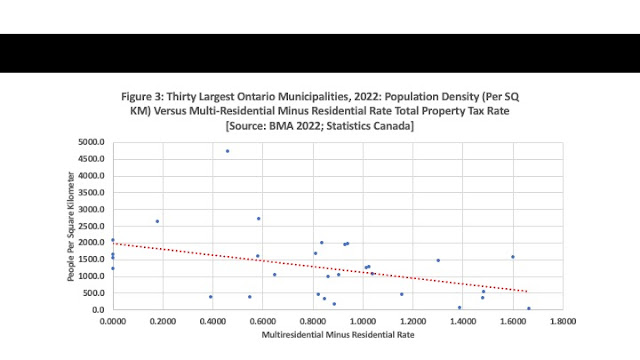

What is more relevant is not the multi-residential tax rate per se but the difference between the multi-residential rate and the single unit residential rate in a given municipality. The greater the gap between the multi-residential rate and the residential rate applied to a given value of assessed property, the greater the incentive to build single residential housing units as opposed to multi-residential units. While Thunder Bay has some of the highest residential and multi-residential total property tax rates in the province, it also has one of the highest differences between the two. Relatively speaking, the larger the gap, one would expect a greater tax disincentive to invest in large multi-unit residential properties, all other things given. As a result, one would also expect to see a relationship between the size of the gap and the degree of urban population density with a larger gap correlated with lower population density.

Figure 3 tries to do exactly that. It plots a scatter-plot for Ontario’s thirty largest municipalities of municipal population density as a function of the difference between the two rates. The larger the difference -that is the higher the gap between multi-residential and residential property rates – the lower the population density, all other things given. Of course, all other things are not given and there may indeed be other variables influencing urban density not just in Thunder Bay but other cities as well. After all, robust economic growth that pours more people into a fixed geographic space is also a way to increase population and urban density. However, parsing everything out would require a fairly expensive study – this is after all, just a blog – but that would mean paying a lot of money to consultants for answers Thunder Bay City Council and Administration probably do not want to hear. Namely, Thunder Bay’s municipal tax system and development policies discourage density and encourage sprawl. Rule of Thumb. If you want less of anything, tax it more heavily.