The City of Thunder Bay’s population according to the Census

of Canada has remained essentially the same since the 1970s with some minor

growth in the surrounding CMA. This has occurred

while elsewhere in the province and country, population soars. Indeed, the city’s growth rate between July

2021 and July 2022 while positive at 0.2 percent, was actually the lowest

in Canada for cities with populations above 100,000.

With every census, there are the usual concerns with

stagnation but despite the census evidence, there are actually two narratives when it comes to

population in Thunder Bay. One story is

that given the city’s growth rate in population, there is a lack of economic

growth and stagnation is a real concern given that population is attracted to

economic opportunity. When combined with

the fact that the city and region appear to be aging faster than the rest of

the province, the prospects for a more dynamic future look increasingly

precarious. However, the other story

often voiced by local officals is that Thunder Bay’s population is

much larger than the official population figures indicate. In this narrative, Thunder Bay is an attractor for a transient regional population that comes in and makes use of its

services.

Even the current Mayor of Thunder Bay recently was quoted

asserting that “he believes there are 15 per cent more people than recorded

by Statistics Canada, adding that’s where a lot of the city’s financial

problems come from, having to provide services for people that aren’t

officially on the books, and hence aren’t counted when senior levels of

government hand out transfer payments.” More directly, he

said: ““We’ll ride with 120,000, but the police know, the hospitals

know, the health-care system knows, and even the mercantile areas know it’s

more than that. There’s more people around and if you spent one hour at city

hall you’d know there are a lot more people wandering around the city than

actually meet any census.” With an offical City population of 108,843 and a

CMA/Metro population of 123,258, the mayor’s assertion suggests that Thunder

Bay’s actual population range from City to CMA is from about 125,000

to 142,000.

Of course, such assertions would be useful if accompanied by

time series data from police, paramedic, and hospital services though even that

of itself is not sufficient. After all,

it is possible to have population growth flat, but usage rates rise. With more use per capita, even with flat

population growth, one could see paramedic or police services rise in total

incidents. Indeed, rising usage for hospital

and paramedic services could be a function of a larger transient population or

it could also be the result of an aging population. However, without more detailed data, simply

saying “if you spent one hour at city hall you’d know there are a lot more

people wandering around the city than actually meet any census” is probably

not going to cut it with the city’s governmental transfer partners.

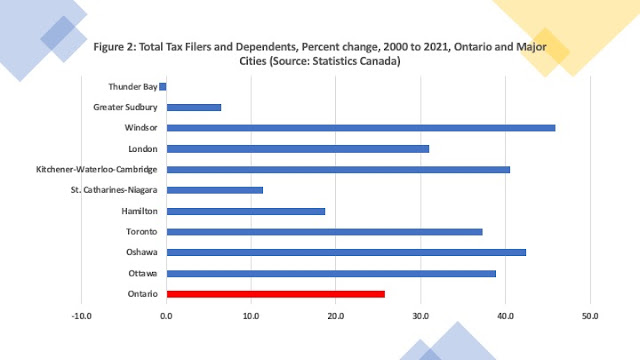

In the search for other approaches to the numbers, another way at looking at growth in a city is through federal

tax filer data collected by the Canada Revenue Agency and disseminated through

Statistics Canada. The accompanying Figure 1 presents an index

for the number of tax filers and their dependents for the period 2000 to 2021 for

Ontario as a whole and a number of its major cities with the year 2000 set at a

value of 100. Over this period, the

total number of tax filers in Ontario rose from 11,331,080 to 14,248,730 which

when normalized with 2000 equal to 100 means Ontario went from 100 to 125.7 for

an increase of 25.7 percent (See figure 2).

Over the same period, Thunder Bay went from 120,140 to 119,180 which

when normalized goes from 100 to 99.2 for a decrease of -0.8 percent. Indeed, of the cities on these two charts,

Thunder Bay is the only one that sees a decrease in the number of total tax

filers and dependents.

Does this mean that the mayor is wrong? Not necessarily. Given

that the assertion is that these additional users of services are transient or

temporary population, there is no reason that they would be registered with a

residential address in Thunder Bay for income tax purposes. All these figures do is confirm the official

narrative from the Census and Statistics Canada that Thunder Bay’s population

is essentially flat and has been for quite some time. If there are indeed a large number of

unofficial residents moving to and from the city using its services, then

Thunder Bay needs to do a better job of presenting a credible statistical

method of capturing that population.