Municipal budget season is underway in cities across Ontario. Hamilton is a particularly interesting case this year given that the initial start of the 2026 budget season saw an 8.9 percent potential property tax increase presented. Hamilton’s Mayor Horwath has waded into the debate with directions to staff to hold the tax increase to 4.25 percent by finding operational efficiencies that do not involve staff cuts. However, according to one report, nearly half of the 2026 operating budget increase is being driven by employee costs with the City of Hamilton’s head count up 12 percent since 2022 and now stands at 9,449.

Getting a grasp on Hamilton’s current municipal finances requires more of a historical perspective. So, what do Hamilton’s finances look like and how have they evolved? Well, that is a good question and an attempt to provide a long-term perspective on Hamilton’s municipal finances is in order. Data for Hamilton is available for 2000 to 2022 from Ontario’s Ministry of Municipal Affairs Financial Information Return. Hamilton – like quite a few other municipalities – appears to have fallen behind in filing their financial reports with the provincial government so 2023 to 2025 must rely on Hamilton municipal budgets.

However, these budgets present financial information in a dizzying and confusing array that overwhelm the reader with detail that make the big picture difficult to see. They are also not standardized in presentation and vary greatly in length with Budget 2023 clocking in at 51 pages, Budget 2024 at 365 pages and Budget 2025 at 434 pages. Trying to make sense of them can be a slog even for an economist and if there is anything the provincial government should do, it is to speed up the reporting of financial information on FIR so the public can maintain a consistent grasp of the numbers when it comes to municipal finance across Ontario.

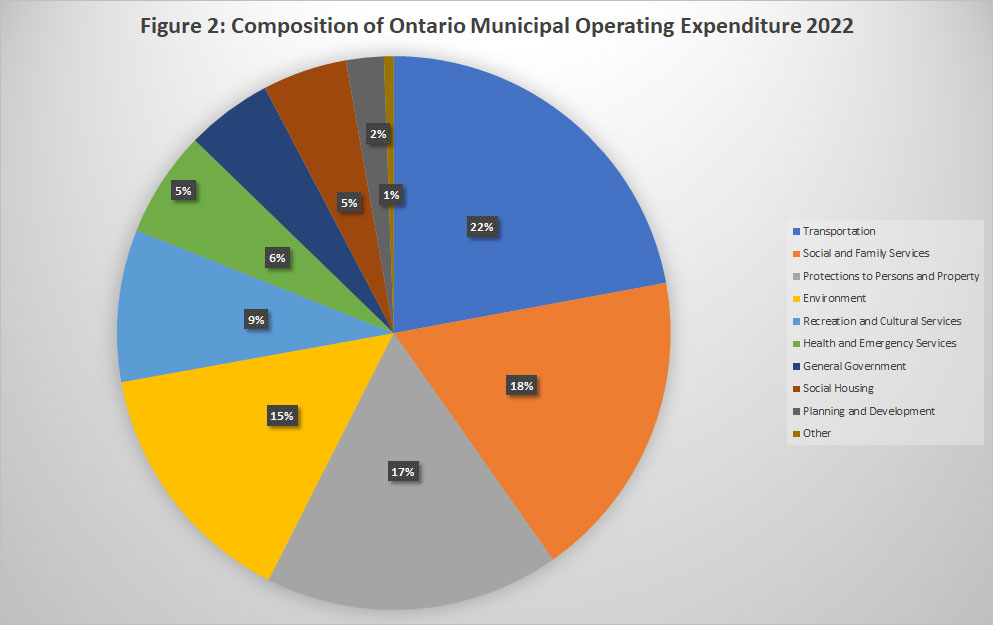

Figures 1 to 5 provide a limited overview of some of Hamilton’s key long-term municipal finance indicators. Figure 1 plots total operating expenditure and total tax revenues for the 2000 to 2025 period. Total tax revenue grew from $486 million in 2000 to $1244 million while total operating expenditures went from $985 million to $2,163 million. There is of course no cause for alarm regarding the gap because tax revenues only fund a portion of operating expenditures with the rest coming from provincial and federal grants, user and licensing fees, investment income, etc.…However, as Figure 2 illustrates, the share of total expenditure accounted for by property tax revenues has grown over time with the linear trend showing an increase from an average of about 45 percent to nearly 55 percent – growth of nearly 10 percentage points. Essentially, municipal ratepayers in Hamilton have been bearing a larger share of municipal operating expenditure over time with average tax revenue per household nearly doubling since 2000 going from $2,544 to $4,863.

Figures 3 and 4 plot the annual growth rates of total tax revenue as well as total operating expenditure and fits trend lines to the data as well as provide the average growth rate for each series over the 2001 to 2025 period. Both tax revenues and total expenditures exhibit rising growth rates from 2001 to about 2010 and then a decline in the wake of the 2008/09 economic slowdown and then an uptick in growth rates after 2019 to the present. Over the entire 200 to 2025 period, tax revenues have grown at an average annual rate of 3.8 percent while total operating expenditures have grown at 3.3 percent. This differential growth has been driven by the rising reliance on taxes over slower growing grants and other revenue sources.

Finally, Figure 5 looks at the evolution of the municipal headcount as well as the wage and salary cost per employee. While the recent increases in head count may seem alarming, it turns out that the current numbers have been higher in the past particularly in the wake of the 2001 amalgamation. The period from 2005 to 2022 has been relatively stable in terms of municipal employment going from lows of approximately 7,300 to highs of about 8,200. The period since 2017 has seen steady growth with employment rising from 7,502 to 9,449 at present – an increase of 26 percent. Since 2017, the number of households in Hamilton has only grown about 12 percent while population has grown nine percent. As well, between 2000 and 2025, the wage and salary cost (benefits not included) per municipal employee has grown from approximately $36,000 annually to nearly $113,000 in 2025 – essentially a tripling of the cost per employee. It should be noted that while the average annual rate of increase of wages and salaries per employee in Hamilton form 2001 to 2025 was 4.9 percent, the average CPI inflation rate for Ontario over the same period was 2.3 percent.

Pulling everything together, it appears that the fiscal challenges affecting the City of Hamilton this year have been brewing for some time. Tax revenues have been growing as a share of total operating expenditure due to slower growth of other sources of revenue. While the average annual growth rate of total tax revenues since 2001 has averaged 3.8 percent, since 2021, the percent increases have ranged from 4.5 to 8.1 percent. Tax revenues have been growing faster than the growth of total operating expenditure but increases in wage and salary costs per employee in particular have been rising faster than tax revenue growth, total operating expenditures, as well as the CPI inflation rate. Whereas in 2000, employee wage and salary costs accounted for 34 percent of operating expenditures, by 2025 they accounted for nearly 50 percent. Indeed, since 2017, the average wage and salary per employee has been over $100,000 and this does not consider the costs of pensions and other benefits.

While Hamilton is not unique in facing municipal fiscal challenges, the increases of the last four years have been particularly large making this year's budget exercise especially challenging.