Budget deliberations will continue this week at Thunder Bay City Council and the conversation to date suggests that there does seem to be some recognition that this year needs to recognize the financial hardship of the current pandemic. However, easing back on tax increases this year and expecting to get back to normal the year after is really also not the right strategy. This does seem to be the source of division right now on Council given the difference of opinion on just how serious future financial challenges are.

The summer saw talk of a tax levy in the 3-6 percent range as a result of increased costs due to COVID but it appears that the substantial amount of federal and provincial aid has dampened that talk to the point where the proposed increase is now 2 percent for 2021. However, many in City administration and on council feel that this is temporary, and we will be returning to business as usual with increases well over three percent in subsequent years.

The response at some of the budget presentations last week was that even the proposed two percent now needs to be reduced further. In response, the call by one councillor to accomplish that by simply taking the money out of City reserves or stabilization fund for this year again reflects the belief that the problems are short term and things will be better next year. This is a mistake given the long-term structural problems affecting City of Thunder Bay finances.

[As an aside, the councilor’s quote that “That stabilization fund is there for crises, like the [2012] flood,” was interesting comment given that the 2012 flood affected several thousand homeowners much like the current leaky pipe pandemic and apparently dipping into the reserves then now seems to be viewed a form of assistance to homeowners. The City has remained tight-lipped on the leaky pipe matter since the start and now especially since it is before the courts as a result of a class action lawsuit. However, the homeowners affected by the 2012 flood have also filed several large lawsuits so one wonders why the double standard in public commentary? Has some sort of self-imposed statute of limitations on discussions expired?]

Thunder Bay’s municipal finances are marked by a long term erosion of its property tax base due to industrial decline and a lack of population growth combined with above average spending and costs due to a higher cost structure acquired during a time when revenues were more abundant. There is a failure to recognize or deal with the problem. This higher cost structure is apparent when Thunder Bay is compared to major Ontario municipalities.

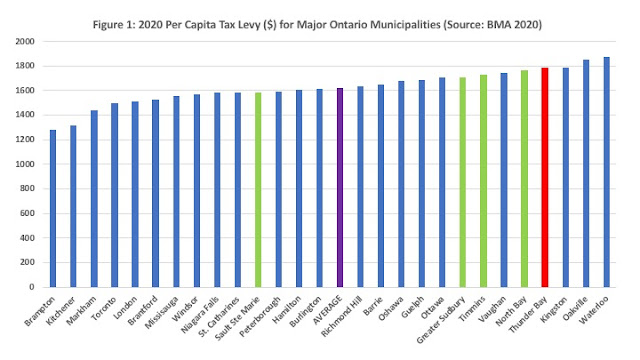

The following figures present municipal spending for Thunder Bay compared to 26 other major municipalities in Ontario for 2020 using data obtained from the BMA 2020 Municipal Report. Note that for municipalities with regional government, in the police and fire categories, spending per capita for the regional functions was included on top of their reported municipal spending. Figure 1 presents the per capita tax levy for all 27 cities as well as the average for them. Thunder Bay does have the fourth highest tax levy [municipal operating spending] of these 27 major municipalities. What is more interesting is when the composition of the spending is broken down a bit.

What

emerges from Figure 2 to 6 is that Thunder Bay spends the most per capita on

general government (administration), police and fire of these municipalities. Thunder Bay spends $241 per capita on general

government compared to the 27-city average of $113 – more than double. It spends $317 per capita on fire protection

compared to the average of $191 and $441 per capita on police protection compared to

the average of $311. While in total, Thunder Bay only spends about 10 percent more per capita than the average, compared to the category averages it spends 116 percent more on general government, 66 percent more on fire and 42 percent more on police.

When these three expenditure categories are summed up, it turns out that Thunder Bay spends nearly $1,000 per capita on general government, police and fire compared to an average of $612 – that is 63 percent more than the average. While northern Ontario municipalities because of their larger urban areas and lower population densities have a tendency towards higher costs and spend more, we are head and shoulders above the rest of the North. Looking at Figure 5, after Thunder Bay at nearly $1,000 comes Sault St. Marie at $752 and North Bay at $736. Sudbury is only at $656.

As

a share of the per capita tax levy (Figure 6), spending on general government, police and

fire in Thunder Bay at 56 percent is approaching nearly 60 percent!

The average across these cities is closer to 40 percent. One cannot simply blame arbitration costs for

police and fire spending in Thunder Bay because all cities in Ontario are under

the same system and salaries do not differ that much across jurisdictions. Based on what is being spent on

administration, police and fire, we are spending an awful lot for government

protection services which makes one wonder if in Thunder Bay we are living in

some type of municipal public sector version of the Sopranos? The cost structure is a problem and require a concerted long term effort to bring costs and spending more in line with other jurisdictions.