It turns out that Ignace is getting its municipal snow grader

outfitted with a “snowgate”. Essentially,

the snow plough is going to have a gate on it that lowers at the end of the

blade when in front of a driveway thereby preventing snow from blocking the

driveway while snow on the street is removed. Needless to say, the thought of not having to deal with a foot high pile of crushed ice and snow at the end of a driveway after a major storm makes winter much more bearable. However, given it is budget season, one wonders how expensive this might be?

As noted in the

CBC story: “The gate cost $15,000, and is easy to operate, Taylor-Hertz

said. The operator of the grader flips a switch, and the gate lowers when going

in front of a driveway. Once past the entrance, the gate comes up, pushing snow

to the side of the road. ‘A couple of our department heads

got together, and talked about getting a snowgate for the snowplow, or the

grader attachment, and it has alleviated a lot of problems for our elderly

residents in our community, by taking the windrow away at the end of the

driveway’."

The “snowgate” is of course essentially a windrow prevention

program as opposed to a windrow removal program but in Thunder Bay it is

apparent our municipal government is capable of neither. The possibility of windrow removal in Thunder

Bay is not a new issue. During the 2020

municipal budget season, this very idea was

discussed in Northern Economist but to no avail. As noted on their web site by the City:

"No, windrows across driveways will not be cleared by City Crews.

Residents are responsible for the maintenance associated with their driveway,

including the portion that is on City property. It is that portion of the City

property which has been designed to provide snow storage during the winter. The

City does not give up the right to store snow in that area of the boulevard

when it allows the residents’ driveway to encroach across City property. It

is important to note City crews have the important task of plowing snow on all

City streets as quickly as possible. Snow removal from driveways is not a

program offered by the City. "

Apparently, our driveways over the boulevard to access the

street are an "encroachment" on City property so they can do whatever

they want with the land.

And of course, it is not just Ignace that seems to be adept

enough to cater to the needs of its municipal ratepayers. Richmond Hill has the Cadillac of programs

and now removes the windrows on all residential driveways. Richmond

Hill windrow removal was implemented in 2019 for all 55,000 households for

a total annual cost of $4.4 million dollars. Markham also does windrow removal

but for qualified registered applicants

who must either be over 60 years of age or if under 60 have a medical note

saying they cannot shovel snow. Even Toronto

has some windrow removal depending on where you live in the city.

While one does not expect the Richmond Hill program, it

remains that when it comes to windrow removal, Thunder Bay is not even trying. Why? That is a good question. After all, when it comes to municipal

spending, Thunder spends one of the highest amounts per capita across major

Ontario municipalities. How onerous might the total cost of $15,000 per city plow be given a $200 million dollar tax levy supported budget?

The answer is it

is all about priorities. While Thunder

Bay does spend one

of the highest per capita amounts of major Ontario cities, it has chosen to

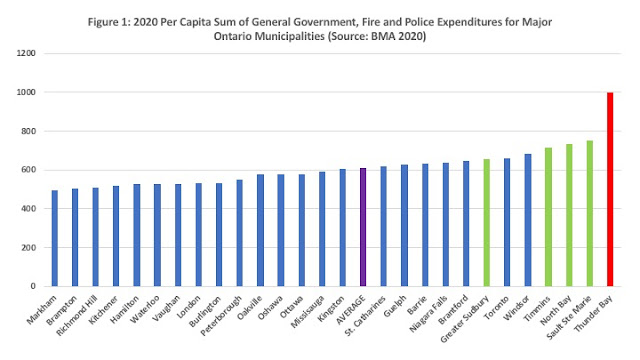

prioritize three things: general government, police, and fire services. Indeed, of 27 major Ontario municipalities,

Thunder Bay spends the most dollars per capita (about $1,000) of its tax levy supported operating

budget on these three things as illustrated in Figure 1. Indeed, nearly 60 percent of Thunder Bay’s

operating tax levy is spent on these three items - again, the highest of these 27 major municipalities.

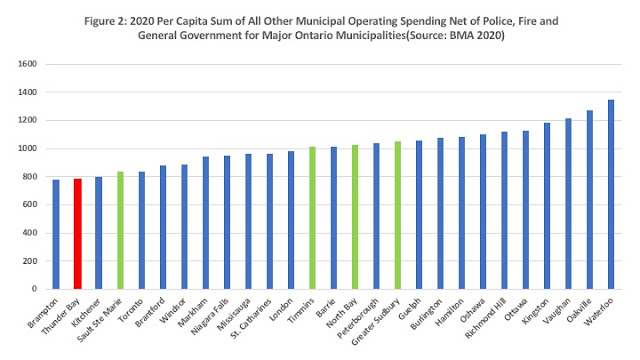

However, as we all learn in first year economics, given a

fixed budget, more of one thing results in less of something else. As a result, as shown in Figure 2, once police, fire and general government are removed from its spending,

Thunder Bay spends the second lowest amount of the same 27 major Ontario municipalities and

the lowest of the five major northern Ontario municipalities. That means relative to other cities, less

money is spent for snow removal, parks and recreation, public transit,

environmental services and numerous other things.

How can this be? In

the wake of my last colorful

comparison using marine metaphors, think now of the City of Thunder Bay as

a Roman war galley. The municipal

taxpayers are the galley slaves at the bottom of the galley propelling the City

forward with their property taxes while sloshing about in the cascading bilge water

provided by innumerable

leaky pipes. On the top deck, along

with the municipal council gathered around their decision table sitting comfortably on their high chairs, are the

neatly arrayed officers of the ship – police, fire and administration standing between the

elevated stern of a new Turf Facility and a prow marked by a new police

station. They are looking proudly forward as they steer the ship into the wild blue fiscal yonder. One can almost hear the beat of

the budget drum as the municipal council intones to the ratepayers in their

best imitation of Quintus

Arrius that “We keep you alive to serve this ship. Row well and live.”

You would like a “snowgate” you say? Don’t be silly. The City of Thunder Bay has already decided

what we need. Keep rowing.