This Monday evening, one of the items on the discussion plate at Thunder Bay city council will be the newest report on tax arrears. This year’s report shows that the problem is definitely worsening in terms of the number of properties in arrears as well as the value of those arrears and the revenue foregone. This year’s list also features the waterfront Delta Hotel which owes $865,277 in taxes to the city of Thunder Bay.

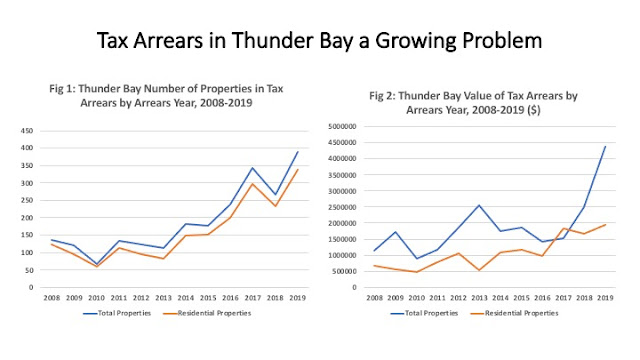

Indeed, 2019 sees a jump in both the number of properties in arrears as well as the value as Figures 1 and 2 illustrate. The total number of properties in arrears grew from 266 to 389 – an increase of 46 percent while the value in total arrears grew from approximately $2.5 million to $4.4 million – an increase of 76 percent. The total value of tax arrears since 2008 comes in at over 10 percent of the value of the tax levy. Residential properties in arrears grew from 232 in 2018 to 338 in 2019 – an increase of 46 percent. Non-residential (i.e. business properties) in arrears grew from 34 to 51 – an increase of 50 percent. Along with the Delta Hotels, some prominent businesses in arrears include the owners of Kangas Sauna as well as Arnone Transport.

Now of course, some might be inclined to argue business has been hard hit by Covid-19, especially in the travel and accommodation sector given Delta Hotel's tax bill but the reality is the money owed is from 2019. Part of the longer-term problem is the economy has been slowing in recent years and tax rates increasing. Part of the problem is also that it is apparent that some businesses are engaging in creative payment solutions – essentially not paying their taxes – until they absolutely have to. It is a bit of a creative financing game that essentially defers taxes into the future while allowing firms to retain the money in the present.

Perhaps the penalties for deferring your taxes in this fashion are not sufficiently large for businesses? According to the City of Thunder Bay:

“All payments must be received by the City by the due date to avoid penalty. Penalties will not be cancelled if you did not receive your bill. You will be charged a late payment penalty of 1.25% on your outstanding balance if your bill is not paid by the due date and on the first day of every month on any outstanding balance. The Not Sufficient Funds (NSF) fee is $40.”

However, one wonders if the creative business approach to property taxation offers a way out for beleaguered homeowners to register their displeasure with the City of Thunder Bay? Just imagine if all those leaky pipe home dwellers actually got organized and started to withhold their payments by six months or so – on an average bungalow with say a $4,000 tax bill, you are probably looking at penalties of about $50 dollars a month (an upper bound based on $4000 - remember you pay in installments so the penalty on a missed installment is less). True, after six months or so that is a substantial amount of change but just imagine if large numbers of homeowners in Thunder Bay got sufficiently incensed to seriously disrupt the City of Thunder Bay’s short-term cash flow – the penalties six months or a year later be damned? Irresponsible? Yes. One should always render unto Caesar what is Caesar’s. Still, one really wonders what it will take to get City Council’s attention? Perhaps business is showing us the way forward?