In lead up to a

decision to approve a new municipal $33

million Indoor Turf Facility that will add $15 million to the City of Thunder

Bay’s debt and take the remainder from the reserves, comes the Treasurers

Report that will be presented at this evening’s Council Meeting. There is a lot there for the year ended

December 31st, 2019 but one of the things that stands out is the

City’s debt position which faces “challenges” that as the report notes include increasing costs of

programs and services, a debt to reserve ratio that is higher than the industry

average (i.e., other municipalities), reduced funding from senior levels of

government and low assessment growth among other things.

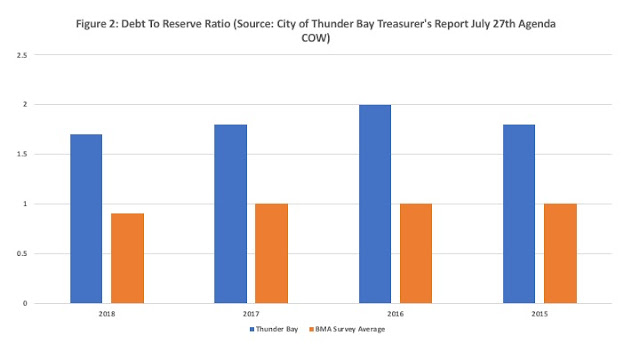

The two accompanying figures drawn from numbers taken from

the Treasurer’s Report highlight quite dramatically what this looks like. Thunder Bay’s per capita municipal debt (Figure

1) rose from $1,618 in 2015 to $1,839 in 2018 – an increase of 14 percent. Over the same period, its provincial municipal

counterparts on average went from $699 per capita to $758 – an increase of 8

percent. By 2018, the per capita

municipal debt in Thunder Bay was essentially more than twice that of the average in

Ontario. Of course, if one has reserves, then the potential impact of the

problem is mitigated. However, as Figure

2 shows, while the average in Ontario is essentially one dollar in reserves for

every dollar in outstanding debt, in Thunder Bay the ratio is nearly double at

1.7 (i.e., $1.70 in debt per dollar of reserves).

Compared to the average in Ontario, we are more indebted and

have a weaker reserve position. We are going

into the 2021 budget season with what is now a “trimmed”

$7 million dollar COVID-19 induced budgetary shortfall which also has to be

dealt with to which one of the proposed solutions among other things is a “special

one-time tax levy.” In this environment City

council is considering adding another $15 million dollars in borrowing which

will add upwards of $130 dollars per capita to Thunder Bay’s total outstanding

municipal debt.

At this evening’s meeting, if councilors are planning

another marathon 5 hour session to things like loitering bylaws and minor

zoning amendments, perhaps they might consider devoting a mere hour or so of their

time to understanding the financial implications of Thunder Bay’s mounting debt

given its historic inability to keep it within “industry averages”.