Well, the City of Thunder Bay’s finances just keep getting better. After projecting a positive variance of $3 million for the 2021 budget year, and then a surplus for 2021 that was supposed to be coming in at $5.6 million, the 2021 surplus has now come in at $10.9 million. Thunder Bay will have its seventh consecutive positive budget variance making for accumulated variances of $31.3 million over seven years. Indeed, this is the largest surplus in seven years. While much of the savings will come from lower-than-expected COVID costs for which the city has received substantial federal and provincial support, it remains that the City of Thunder Bay could obviously use some some help in crafting their budget projection and forecast models.

Figure 1 plots the annual tax levy increase since 2015 against

the corresponding surplus at year end.

For example, in 2015, the tax levy increase was $9.4 million – a 5.7

percent increase on a $164.7 million levy the year previous. The year’s end saw

a positive variance of about $1 million which on $174 million tax levy was just

over one-half of one percent. Since

2015, however the size of the surplus has increased substantially, often coming

close to matching the size of the tax levy increase that year. In 2017 for example, the levy increase was

$5.96 million – a 3.3 percent increase – but the year-end surplus came in at

$5.6 million – almost 95 percent of the value of the original levy. For 2021, there

is now a surplus of $10.9 million – which is more than double the original tax levy

increase of $4.3 million. This is indeed

a first, a surplus bigger than the year's tax levy increase. I suppose if they had some creative economists working for them, the City of Thunder Bay could spin this as a tax levy surplus multiplier of 2.53.

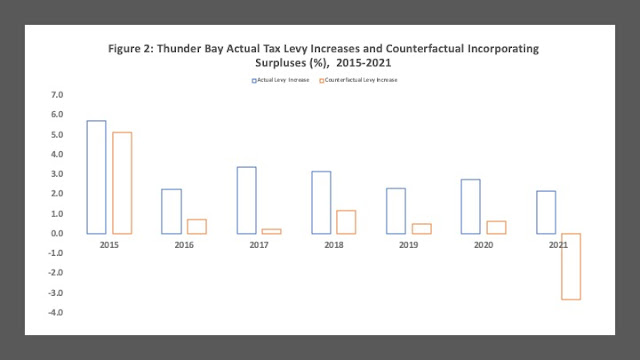

If Thunder Bay had been able to correctly forecast the surplus each year and implement a tax increase incorporating the surplus and balancing the budget, what could have the alternate tax levy increase have been? Figure 2 plots the actual percentage tax levy increase since 2015 and the alternate increases. In 2017, for example, the budget could have been balanced with an increase of 0.2 percent but instead there was an increase of 3.3 percent. The year 2020 saw an increase of 2.7 percent but all that was needed is an increase of 0.6 percent. Meanwhile, the surplus for 2022 means that rather than a 2.1 percent levy increase, there could have been a levy reduction of 3.3 percent.

Outrageous? Not so much as the other shoe that has dropped in the face of growing surpluses - a hefty pay increase for some City Managers. Some managers this year will see raises as high as 12 percent with the range for 319 management and non-union staff ranging from 4 to 12 percent this year. Given the stress of managing city services during a pandemic, one can certainly understand the need for raises. At the same time, there have been a lot of stressed-out public-sector employees in health and education and guess what? The provincial government held them at one percent a year for the last three years. What should we think of all this during a municipal election year? Well, here is another great juxtaposition – the City of Thunder Bay is offering free compost to residents while quantities last with a half-ton load limit per person. With a $10.9 million dollar surplus, one would think the supply of compost would be endless. They really have stepped into it this time.