Like a zombie that keeps coming back to life, the multi-use indoor turf facility project is back on the agenda at Thunder Bay City Council this evening as a report is received on the eight outside proposals that were commissioned. And in an apparently blatant disregard for transparency, the details of the discussion will not be shared with the public. However, the decision has been further complicated by a new application for federal funding on which the City awaits an answer with the funding apparently tied to building a facility that conforms to green and inclusive community building conditions. This of course raises the question as to what the actual price tag for such a facility will ultimately really be.

This application is for approximately $22 million dollars and that is expected to cover about half of the costs so we are looking for a total price tag of about $44 million of which half would supposedly come from federal funding. And yet, the question is whether the costs of the new building will now change substantially given that it must conform to the requirements of the federal funding program. City council rejected the proposal to build the facility when it was $39 million so getting it for substantially less in terms of City dollars may be attractive to those on council who like to pay lip service to the Zeller's Rule - the lowest price is the law.

At the same time, the application process for the new funds is competitive and Fort William First Nation has also asked for $25 million from the fund to build a long-term care home. As elastic as the federal budget constraint seems to be these days one suspects it is unlikely Thunder Bay’s cabinet representative is going to be able to swing both projects. After all, Minister Hajdu’s star seems on the wane given what some might interpret as a demotion from Health.

The minister was not even able to use her clout to secure a return to international flight status for Thunder Bay’s airport for the coming winter getaway travel season meaning no return to direct flights to places like Cuba and the Dominican Republic in January and February. And as Indigenous Services Minister, it would be awkward to say the least to have funding for the turf facility approved in her hometown while the needs of indigenous long-term care are neglected.

So, Thunder Bay seems to be about to embark on another divisive and argumentative round of talks over a project that many in the community are now opposed to in the wake of numerous other city issues with good odds that nothing is going to happen. Even if a project is approved, often it does not happen as those waiting for the transitional housing project on Junot Avenue have discovered.

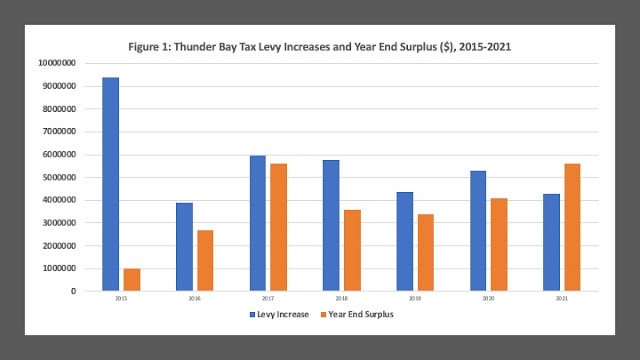

Still, the fact that this project still resurfaces and has its proponents begs the question of why so many members of council are so devoted to seeing it go ahead and staking so much political capital on the project considering the other problems this city faces. There is a lot going on here. There are homeless encampments in the city, there are homeless people wandering the streets of major thoroughfares at peak traffic times soliciting funds at intersections, there are hundreds showing up for meals at the local soup kitchens. Homes are still having their front lawns dug up in the wake of the sodium hydroxide leaky pipes fiasco that has affected thousands of homeowners. And tax rates having been rising over the last few years well in excess of the amounts necessary to fund City services.

With so much on its plate and an election coming soon, who benefits from continuing this discussion? Good question.