The Canadian Institute for Health Information (CIHI) release of the National Health Expenditure Trends 2021 provides a much awaited first macro snapshot of what happened to Canadian health spending during the COVID-19 pandemic. Canada is expected to spend a new record of $308 billion on health care in 2021 — $8,019 per Canadian. It is also anticipated that health expenditure will represent 12.7% of Canada’s gross domestic product (GDP) in 2021, following a high of 13.7% in 2020. A new feature of the numbers this year is the government COVID-19 response funding which in 2021 constitutes 7% of total health spending. The COVID-19 response funding includes money for treatment costs, testing and contact tracing, vaccination, medical goods, and other related expenses and is a separate category from the standard ones used.

Once one starts to examine and analyze spending both including and excluding the COVID-19 response spending provided, as well as adjusting for inflation and population growth, the picture looks more variable depending on the categories examined, the financing sector considered, and the province involved. For example, private sector health spending was hit quite hard and categories such as other professionals and hospital spending also saw declines in real per capita spending.

When provincial-territorial government health spending is examined, their real per capita total health spending in 2020 rose 8.1 percent but once the COVID-19 response is factored out their spending declined by about one percent though it is also expected to rebound in 2021. Hardest hit in provincial-territorial health spending in 2020 in terms of percentage declines in real per capita spending: physicians (-5.8) other professionals (-6.1), drugs (-2.3) and hospitals (-0.5). Meanwhile, public health grew 4.1 percent, other institutions (including long-term care) grew 1.2 percent while capital spending grew 10 percent.

These results are not unexpected given the decline in surgeries and physician visits brough about by the pandemic. The closing of outpatient departments and postponing of medical visits and procedures during the height of the pandemic meant a reduction in some aspects of health service provision and health spending. According to CIHI’s own analysis of COVID-19’s effect on hospital care services, from March to December 2020, overall surgery numbers fell 22% compared with the same period in 2019, a drop of 413,000 surgeries.

Moreover, real per capita spending growth net of the COVID response funding also varied across provinces in 2020 (See Figure 1). While Newfoundland and Labrador, Prince Edward Island, New Brunswick, Quebec, Manitoba, Saskatchewan, and Alberta saw a decline in real per capita spending net of COVID-19 response funding, Ontario, British Columbia, and Nova Scotia saw small increases with Ontario the largest at 1.2 percent. New Brunswick, Quebec and Alberta saw the biggest declines in real per capita health spending at -3.3, -3.5 and -3.6 percent respectively. This demonstrates that during the health system disruption of the pandemic, the decline in service provision at least as measured by real per capita spending, was greater in some provinces relative to others.

In 2019, Ontario’s total provincial government health spending was $63.1 billion and in 2020 including the COVID-19 response funding it soared to $72 billion. In 2021 it is expected to reach $75.2 billion including the COVID funding response. Even when the COVID-19 response is removed, Ontario still saw increases in health spending with provincial government health spending net of COVID forecasted at $67.4 billion in 2020 and $71.7 billion in 2021. Moreover, these increases continue once adjustments are made for population and inflation.

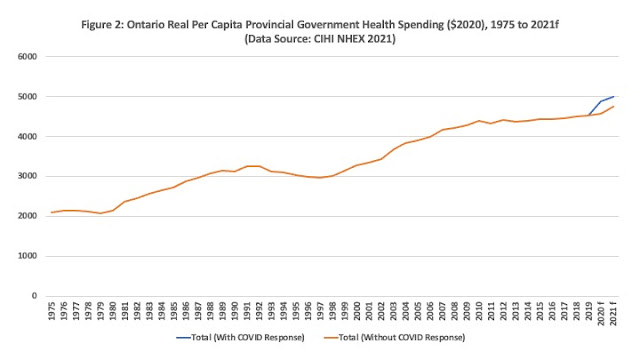

Figure 2 plots real per capita provincial government health spending in Ontario in $2020 from 1975 to 2021 calculated from the CIHI data. Spending growth moderated substantially after 2010. Whereas the average annual growth rate of real per capita provincial government health spending from 2000 to 2009 averaged 3.1 percent, for the period 2010 to 2019 it grew below 1 percent. However, when COVID-19 spending is factored in, real per capita provincial government spending grew 8.1 percent in 2020 and 2 percent in 2021. When you factor out the COVID-19 response, the growth rates are 1.2 percent and 3.9 percent respectively.

Finally, Figure 3 looks at real per capita provincial government health spending growth by major categories. Hospitals declined in 2019 by 1.2 percent but then grew at 2.1 percent in 2020 and can be expected to grow 1 percent in 2021. Other institutions (including long-term care) also shrank half a percent in 2019 but then grew 4.4 percent in 2020 and is expected to grow 18.6 percent in 2021. Physician spending grew 1.8 percent in 2019, then shrank by half a percent in 202 and is expected to rise 1.7 percent in 2021. Other professionals (e.g., provincially funded dental and optometry) fell 2 percent in 2020 but can be expected to grow 6 percent in 2020. Provincial government drug spending in real per capita terms fell in both 2019 and 2020 but is expected to grow 9 percent in 2021. Public health saw increases close to 10 percent in each of the three years reported in this chart. Administration on the hand has shrunk in each year including an 18 percent drop in 2020.

So, the impact of the pandemic on provincial government health spending in Ontario after the COVID-19 response has been factored out appears to be a renewed focus on making health a priority at least for the immediate future. Whereas pre pandemic the focus appears to have been on restraining expenditure growth, the stops are off for the time being. Whereas real per capita spending growth was under one percent for the 2010s, there is a reversal underway with major increases in other institutions (mainly long-term care), other professionals and drugs.