As 2023 winds down and 2024 arrives, a retrospective combined with a look ahead on the economy is a timely exercise. The economic indicators to date for 2023 suggest that Thunder Bay has had a very good year. Average monthly employment in 2023 to date is up about 3 percent over 2022 – representing nearly 2,000 new jobs. However, while average monthly employment appears to have recovered from the pandemic, it has yet to permanently surpass the 2018 level. However, on the plus side, the accompanying figure suggests that Thunder Bay’s employment does appear to be on a modest longer-term upward growth trend after years of being seemingly flat. As well, the seasonally adjusted unemployment rate remains around 5 percent and the average for 2023 is lower than 2022 which suggests that the local labor market does not have a lot of slack in it.

Along with employment opportunities being generated in large public sector construction projects in both the city and the region, there is also substantial activity in the local retail and tourism /hospitality sector with the opening of new retail and food service outlets as well as a very successful cruise ship season. The port has also seen growing grain shipments as Thunder Bay resumes much if its traditional role in Canada's grain transport network. On the housing front, while starts are not at historic highs, there nevertheless has been substantial activity particularly in the multi-residential unit sector. Overall, Thunder Bay has seen healthy economic activity despite the recent rise in interest rates. This is the result of continued activity in its traditional sectors of construction, forestry and port activity combined with activity on the mining front. As a result, population can be expected to grow albeit at rates still well below provincial and national growth rates.

Perhaps the biggest impact locally is the construction of Thunder Bay’s $1.2-billion provincial jail which until completion in 2025 will drive Thunder Bay’s labor market and economy even if the Canadian economy slows down in 2024. At the same time, the massive project has complicated the availability of local trades people with lengthy waiting lists for electricians, plumbers and carpentry services for smaller projects and home renovations assuming that you can even get trades people to agree to come. However, completion of the jail project will likely see a ramping down of economic growth in the economy and in the absence of equally large new projects some alleviation of a relatively tight labor market particularly in building trades.

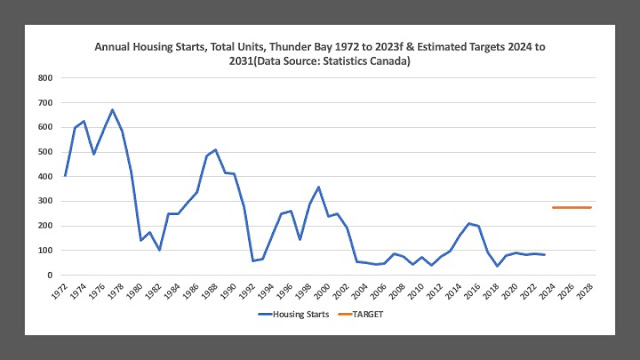

According to the Conference Board of Canada, housing starts in Thunder Bay are expected to grow but the numbers in their forecast seem unlikely to meet the 275 annual units required to meet provincial targets. Nevertheless, Thunder Bay appears to be pressing forward with plans to apply for federal funding to build two thousand homes over the next three years - over 600 new units a year. An average of 600 to 700 new homes a year is an amount that has not been seen in Thunder Bay since the baby boom years of the 1960s and 1970s. Ultimately the success of such a grand scheme depends on local demand and this depends on what interest rates are like, what the state of the economy is and whether people have the incomes and purchasing power to pay for the housing. Never mind if enough building trades people are available to actually do the work.

Going into 2024 and as noted in the most recent Conference Board Report, one can expect to see employment growth in construction, transport and warehousing, health care and social assistance, accommodation and food services and public administration. Other sectors such as manufacturing, utilities, professional and scientific services, and educational services are expected to remain flat or even decline slightly. Declines can particularly be expected in the areas of educational services given regional demographics and public funding levels, as well as the local FIRE sector (finance, insurance, real estate) given the rise in interest rates. The post-secondary sector in Thunder Bay is also in uncertain territory given the dependence on volatile flows of international students and lack of clarity from the provincial government as to what directions in funding it may pursue in the wake of the Blue-Ribbon Panel Report. While the Blue-Ribbon Report called for increases in tuition and the provincial government grant to post-secondary institutions, the government’s response to date has been to continue to seek efficiencies which means the structural problems of university finances are unlikely to be resolved anytime soon.

Going forward there is also some economic uncertainty on several fronts. It remains to be seen what the long-term outcome of the sale of Resolute Forest Products to Atlas Holdings will be on both local production and employment levels. The future of the Alstom plant is also always precarious in the absence of a major transit project to generate longer-term employment. As for the future of lithium refining in the region by companies such as Rock Tech Lithium, Toronto’s Avalon Advanced Materials and Green Technology Metals of Australia, there are positive expectations that these projects will finally trigger the long-awaited mining boom given the flurry of recent announcements and media stories.

However, despite purchases of waterfront land, to date these are all plans, and the industry appears to be waiting for public money to assist their development. It is unclear if any of these companies will be able to raise the necessary funds either publicly or privately to finance their activity in the face of international competition in the industry with other players with their infrastructure needs already in place. As well, demand for fully electric vehicles – a key driver of the demand for lithium – has also been exhibiting weakness given the cost of the vehicles, their range, the availability of charging facilities and competition from alternatives such as hybrids as well as traditional gasoline powered vehicles. As a result, the lithium refining industry in Thunder Bay and Canada while hopeful in its signs, may remain a work in progress for the foreseeable future.

Of course, in terms of what Thunder Bay can do to deal with all these changes and the economic uncertainty does not have a simple answer. Thunder Bay, much like Canada as a whole, is a small economy unable to influence global economic and political trends beyond its borders. Nevertheless, given the current buoyancy in the local economy, it is important to make hay while the sun shines. Going forward, Thunder Bay must continue to make itself as attractive a jurisdiction for business investment as it can. That means continuing to provide quality of life amenities, a range of useful and timely services for all demographic groups and a competitive local municipal service and tax environment. Needless to say, at particularly at the municipal level, there will be a need to provide more while keeping the tax burden down – a tall order to fill at the best of times.