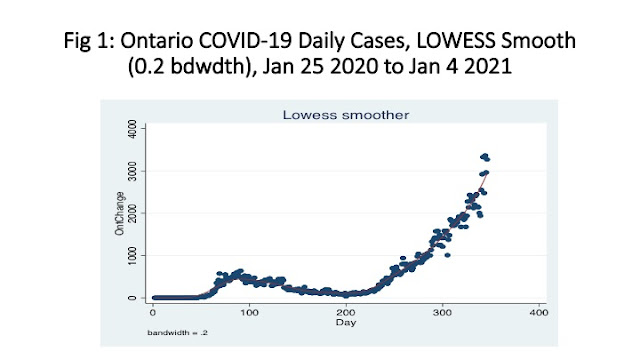

The annual Canadian Institute for Health Information (CIHI) National Health Expenditure (NHEX) data tables and report release was today and as a member of the CIHI NHEX Advisory Panel, I always look forward to the new report. With 2020 being the year of COVID, the impact on health spending in Canada is of particular interest. To say that there has been a lot going on is of course the understatement of the year. The numbers for 2018 and 2019 have been updated with upward revisions with spending in those years reaching $254.6 and $265.5 billion respectively bring the health expenditure to GDP ratio for 2019 up to 11.5 percent. Indeed, total health spending as a share of GDP in Canada has now been estimated at 11.5 percent for three years running. However, unlike the 2019 release which featured a forecast for 2019, the 2020 numbers do not provide a forecast for 2020.

The numbers for 2020 are a lot murkier as while there have been spending announcements totalling $29 billion across all levels of government, the net results on spending are still unclear. As the report notes: “On one hand, there are significant spending implications associated with the treatment of a large number of patients with COVID-19 symptoms (often with prolonged stays in intensive care associated with high resource use), widespread testing and tracking

of the population, the creation of excess health system capacity and the purchase of personal protective equipment (PPE). On the other hand, health systems have observed a reduction

in overall health service delivery across the continuum of care…”

For example:

· Visits to emergency departments (EDs) across Canada declined by almost 25,000 a day in mid-April 2020 — about half the usual number of patients. By the end of June 2020, visits remained lower than is typical for that time of year (about 85% of June 2019 volumes).

· From March to June 2020, overall surgery numbers fell 47% compared with the same period in 2019, representing about 335,000 fewer surgeries.

· In the 3 provinces where data is available (Nova Scotia, Ontario and Manitoba), the number of patient visits (in person and virtual) to all physicians dropped by 13% to 33% from March to June 2020.

So, the impact of COVID on health spending in Canada in 2020 appears to still be a work in progress. While there have been unprecedented increases in announcements of spending on health and costs associated with treating COVID-19, at the same time there may have been a decline in spending on a lot of other things meaning the net impact for 2020 still has to be worked out. If one were to add the $29 billion in spending announcements to the totals for 2019, one might obtain a potential upper bound spending estimate for 2020 of $294.5 billion which when applied to a GDP estimate for 2020 from the last Federal 2020 fall economic update of $2.183 trillion (avg of private sector forecasts), then the health expenditure to GDP ratio could be 13.4 percent.

However, the examples of service volume reduction during the pandemic provided in the report suggest that there may be a significant decrease in spending in non-pandemic related health spending offsetting the increase in pandemic related spending thereby possibly even reducing total health spending from the 2019 level. It is indeed an interesting possibility.

If total spending in 2020 stays at the 2019 level, the health spending to GDP ratio becomes 12.2 percent – not an outrageous spike from 11.5 percent at all given a pandemic year with hundreds of billions of dollars in deficit spending. If it goes lower than the 2019 level, one can expect a health spending to GDP ratio in 2020 not much different from 2019. Again, this may be possible given the prospect that the provinces may have had some difficulty in spending all of the money the federal government has transferred to them for health and pandemic assistance as reported in this story in the Toronto Star.

Of course, one can understand why care has to be taken in making sure the right numbers for 2020 are calculated. The pandemic response in Canada has been a year-long case of playing catch-up whether it was with recognition of the problem, deciding what to do and then implementing measures. After a year we seem to still be debating travel restrictions. The erratic vaccine acquisition and rollout and the ongoing saga of testing or not testing at airports are just high-profile examples of how our governments – federal and provincial – just do not seem to be able to get things done either quickly or well. If on top of all this health spending during the 2020 pandemic year actually goes down, then there will be yet another barrage of criticism for all governments – to say the least.