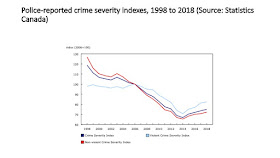

The most recent

set of crime statistics for Canada revealed that police-reported crime in

Canada, as measured by both the crime rate and the Crime Severity Index (CSI),

increased for the fourth consecutive year in 2018, rising 2%. The accompanying figure below further

reinforces the fact that after years of decline – a decline that stretches back

to the 1990s – crime rates are rising.

Of course, all of this begs the question as to why crime rates are

rising again after years of decline.

Explaining the drop in crime rates has been

a

source of some debate. The fall in

crime rates since the 1990s in Canada as well as the United States has been

attributed to a number of factors including new policing strategies, changes in

the market for illegal drugs, an aging population, a stronger economy, tougher

gun control laws and increases in police numbers. As for the impact of the

economy on crime, well that is also a source of debate.

On the one hand, the intuitive feeling is

that a weak economy should cause people to turn to crime. Yet, many studies of the relationship between

the economy and crime have found statistically small relationships between

unemployment and property crime and often no relationship between violent crime

and unemployment. It has also been argued

that economic downturns may actually reduce criminal opportunities as when unemployment

is high more people are at home "protecting" their property and

when out and about they carry less cash and possessions.

If the latter is the case, one could make

the argument that the strengthening economy of the last couple of years has

been a key factor in fueling the recent surge in crime. Unemployment rates in Canada are at historic

lows and to add fuel to the fire – so are interest rates. Low interest rates mean that even if more

employment today is part-time or uncertain, people are still able to consume more and

go out more simply by borrowing more. Indeed,

Statistics Canada also noted recently

that the seasonally adjusted household credit market debt to disposable income

ratio increased to 178.5 percent in the 4th quarter of 2018.

More debt to fuel spending on homes and

basic consumption frees up resources to spend on more illicit things like

illegal drugs and much of the recent crime increase is drug related.

With unemployment low and cheap money

sloshing around both fueling spending and consumption, the opportunities for

crime may have mounted. It is certainly a point worth considering.