Well, in what has become almost a form of annual homage to Gilbert and Sullivan, Ontario released its public sector salary list yesterday and there are a lot of "victims" on this year's little list - 131,741 to be precise. The number has grown steadily since the list was first published in 1996 with 4,576 names on the list and since the $100,000 threshold remains the same without any inflation adjustment, twenty years of salary progression has increased the number of names above the threshold. Indeed, if you adjust for inflation, the threshold today would be about $150,000 and about 85 percent of names currently on the list would be eliminated bringing it down to about 20,000 which still is nearly a quadrupling of numbers since 1996.

However, there is a reluctance to adjust the threshold to account for inflation and as the Premier of Ontario herself has noted, the people of the province have a right to know what public servants are earning because after all $100,000 is still a significant amount of money to the "vast majority" of Ontario residents. This is a somewhat curious statement given what seems the Premier's lack of concern about other big numbers when it comes to Ontario's public finances. For example, the provincial net debt is at about $312 billion which is indeed a significant amount of money as is the nearly $12 billion dollars annually required to service it.

Perhaps the problem is the difficulty many have in dealing with numbers that are so large that they are outside their daily experience. After all, most people deal with numbers in the thousands when it comes to salaries and annual living expenses rather than billions. What is needed here is perhaps some type of currency conversion mechanism that translates these large numbers into something the public can more easily grasp.

So, how many "Listers" at a threshold of $100,000 would make up the Ontario public debt? That number comes out to 3,120,000 - which is still a very large number - and represents just under half of total employment in Ontario which is at about 7 million people. However, a number in the millions is still very large. Ontario this week will deliver a budget and the expectation is that the deficit may reach $8 billion. How many "Listers" would make up an $8 billion deficit? Well, 80,000 which is a much more manageable number but as a number still higher than the median income of Canadians. How many Presidents and CEOs of the Independent Electricity System Operator fit into the net public debt? About 416,000. Ministers of Northern Development and Mines? You can get 1.89 million of those. But I digress...

It remains that the list is needed as an indicator of public sector spending as well as to provide transparency as to what the public sector spends notwithstanding what has become an exercise in showmanship without any effort to gain some additional insight and understanding about public sector spending. Indeed, the fixation on the large numbers in the annual release masks the fact that there should be some serious concerns expressed about how the list is constructed, transparency and indeed what it tells us about people and what they are paid and how that information is used.

First, while the "List" was supposed to be an accountability device that would somehow restrain the growth of public sector salaries it remains that it has not. Indeed, I would venture that making the salaries public has actually provided a basis of individual comparison that has resulted in driving salaries up in the broader public sector not just in Ontario but across the country. You don't hear about private sector salaries being driven up in part because that information is usually considered proprietary or confidential and its absence hinders the ability of individuals to make comparisons and decide they deserve more and make use of it to negotiate a higher salary.

Second, the list is inequitable because it separates public servants based on an arbitrary threshold that was selected because at the time it seemed like a big, round number - $100,000. However, for true accountability, all public sector salaries should be reported. There should be two lists released every year - a public sector salary disclosure list with those making over $100,000 and another with those making under $100,000. Yes, the list would be very very large but that would be the point. There are a large number of broader public sector workers and public sector spending in Ontario is not just driven by the 131,741 people making over $100,000 but also by the over 1 million people in the broader public sector making under $100,000. Would it be an invasion of the privacy of those individuals making a more modest income of say $80,000. Well, what do you think releasing a list of the salaries of someone making $100,000 actually is in a town with only 100,000 or 5,000 people? We don't all have the relative anonymity of living in the GTA.

Third, the list also needs to be expanded to truly reflect the spending of public sector money on compensation. A case in point, universities must report all of their employees making over $100,000 because they are a public sector agency but it remains that universities in Ontario today only directly get between 40 and 50 percent of their funding from the Ontario taxpayer. The rest is own source revenue generation and tuition and while you can argue that many Ontario students get loans or even free tuition from the taxpayer that still does not sum up the public sector funding share to 100 percent. University professors do not get 100 percent of their salaries from the Ontario taxpayer and yet 100 percent of their salary is reported. On the other hand, physicians who are nearly 100 percent taxpayer funded are not on the list (unless they are directly salaried or employed by a public agency) because they are independent contractors. Two points here: 1) a taxpayer dollar is a taxpayer dollar no matter how it is spent and 2) I'm surprised universities have not been more enterprising in redefining how their faculty are paid thereby removing large numbers of them from the list.

So, there you have it. I think the list released under the Public Sector Salary Disclosure Act is important and part of the mechanism of accountability and democracy in government. However, by focusing only on salaried employees of public sector agencies and government making over $100,000 a year misses the point as to how large the public sector actually is when it comes to employment and the spending of taxpayer dollars. The list should be expanded. As the song goes, the task of filling in the names I'd rather leave to you.

Saturday, 24 March 2018

Friday, 23 March 2018

Art in Northern Ontario: A Visit with Visual Arts at Lakehead University

The creative arts are a fundamental component of life and the human experience. Northern Ontario and Thunder Bay in particular are blessed with vibrant and engaged arts communities whose creative work and activity deepens the regional quality of life. In Thunder Bay, a vital component of the creative arts is the Visual Arts Department and associated programs at Lakehead University where the faculty and students have been contributing to the regional arts scene for decades. Many generations of artists have acquired and honed their skills in the facilities and programs of Lakehead's Visual Arts Department.

This week, I received an in depth immersion in visual arts and the creative process as a result of my role as a reviewer for the Quality Assurance review of the visual arts program at Lakehead University. I joined Sally Hickson from the University of Guelph and Laura Peturson from Nipissing University and spent two days visiting with staff and students at the Visual Arts Department at Lakehead. It was certainly an illuminating experience learning about the different streams of the program and it was an eye opener learning about the capital intensity of the program given the facilities and equipment required to mount a quality program in the arts. It was quite instructive learning about ceramics, printmaking, painting, drawing and sculpture.

The students and faculty of the Visual Arts program regularly exhibit at the Thunder Bay Art Gallery as well as with other private galleries and their work is an impressive contribution to the region's cultural assets. Much of their work is also showcased on campus and the recent opening of the Alumni Commons at Lakehead provides an attractive venue for their work. All the best to the students, faculty and staff of the Visual Arts Department at Lakehead University.

The students and faculty of the Visual Arts program regularly exhibit at the Thunder Bay Art Gallery as well as with other private galleries and their work is an impressive contribution to the region's cultural assets. Much of their work is also showcased on campus and the recent opening of the Alumni Commons at Lakehead provides an attractive venue for their work. All the best to the students, faculty and staff of the Visual Arts Department at Lakehead University.

This week, I received an in depth immersion in visual arts and the creative process as a result of my role as a reviewer for the Quality Assurance review of the visual arts program at Lakehead University. I joined Sally Hickson from the University of Guelph and Laura Peturson from Nipissing University and spent two days visiting with staff and students at the Visual Arts Department at Lakehead. It was certainly an illuminating experience learning about the different streams of the program and it was an eye opener learning about the capital intensity of the program given the facilities and equipment required to mount a quality program in the arts. It was quite instructive learning about ceramics, printmaking, painting, drawing and sculpture.

The students and faculty of the Visual Arts program regularly exhibit at the Thunder Bay Art Gallery as well as with other private galleries and their work is an impressive contribution to the region's cultural assets. Much of their work is also showcased on campus and the recent opening of the Alumni Commons at Lakehead provides an attractive venue for their work. All the best to the students, faculty and staff of the Visual Arts Department at Lakehead University.

The students and faculty of the Visual Arts program regularly exhibit at the Thunder Bay Art Gallery as well as with other private galleries and their work is an impressive contribution to the region's cultural assets. Much of their work is also showcased on campus and the recent opening of the Alumni Commons at Lakehead provides an attractive venue for their work. All the best to the students, faculty and staff of the Visual Arts Department at Lakehead University.

Sunday, 18 March 2018

Making Thunder Bay's Next Municipal Election Count

We are about six

months away from Thunder Bay’s next municipal election and the race for the

mayor’s chair and council spots represents an opportunity to examine directions

and priorities. The last election was

obsessed with the event centre and the issue was a distraction from important

issues such as the sale of municipal public assets, economic development, the

city’s economy, the sustainability of municipal finances as well as the ongoing

saga of infrastructure renewal and in particular the James Street Bridge which

has now been closed to vehicular traffic since 2013.

Sadly, with the

exception of the events centre, which has ridden off into the sunset for the

time being, all of these other issues are still ongoing. And of course, added to all of these issues

are those with respect to relations with First Nations as well as court cases

involving the city’s politicians and administration. Needless to say, Thunder

Bay has garnered an inordinate amount of negative attention on the national

stage in areas under the purview of municipal government and such attention is

certainly not a magnet for business investment.

When it comes to

economic development and the city’s economy, it remains that both population

and employment

levels in the city have been flat for the last four years. The low unemployment rate in the city results

from a labour force that has shrunk faster than employment and of itself is not

a positive harbinger for the future. Waiting

for the Ring

of Fire to kick start the economy appears to be a process akin to Waiting for Godot

and all the talk of smelter locations in the world will be of no avail given low

current chromite prices. As for the

current trappings of prosperity in the city, they are largely the result of a

large public sector and associated public spending which after the June

provincial election could very well come to a crashing halt.

Of course, even without

long term private sector wealth creation, the illusion of prosperity created by

public sector spending has helped fuel municipal

government spending and tax increases which over the last few years have

averaged above the city’s inflation and GDP growth rates. Moreover, there has been a continued shift of

the tax burden onto the residential ratepayer and they now account for about 70

percent of tax revenues. Added to this

are the continued steep increases in user fees and charges which given the talk

about “rainfall

taxes” show no sign of abating anytime soon.

Indeed, the thirst for

residential tax revenues also results in city council giving the go ahead to

new urban residential developments outside core areas that while adding to the

tax base in the short term also add to urban sprawl and require municipal servicing

whose maintenance will add to city expense in years to come. The sustainability of this type of short term

development formula should be a topic for debate and discussion but again it is

an issue the politicians are happy to ignore when it comes to an election year.

So, what is to be

done? Well, for starters Thunder Bay residents need to pay closer attention to

the fiscal, economic and social issues affecting the city and ask candidates more

pointed questions about what solutions might help address the situation. Perhaps one should ask why anyone might want to buy

a new house in Thunder Bay if the property tax bill for a new bungalow is going

to be in the range of $5000 to $7000 onto which will be added another $1000 a

year in water and sewer charges.

Given the length of

tenure that many current members of council have had, a legitimate question is

whether or not Thunder Bay might not be better off with a substantial transfusion

of new blood on City Council with new ideas and new energy to look at new ways

of doing things. After all, current

members of City Council have generally been the most comfortable with solutions

that involve raising taxes and spending more money. While the claim is often made that millions

in efficiencies and savings have been implemented, the fact is the tax levy continues

to grow which means total spending is going up and not down.

Making Thunder Bay’s

next municipal election count requires making an effort to create real change

in the way municipal issues are dealt with and that requires some new blood. It

truly is time for change.

Sunday, 11 March 2018

Toursim and Travel in Ontario: A Target for Northern Ontario Tourism

My last post was on

border crossings into northwestern Ontario at Pigeon River and Rainy

River. This type of data has always

interested me because my academic career began approximately when the Canadian cross-border

shopping frenzy of the late 1980s and early 1990s took place. In 1980,

Canadians made 22.1 million same day auto trips to the United States and this

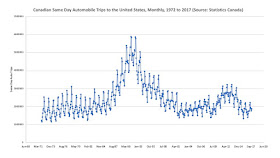

rose to 25.2 million in 1985 and hit 53.2 million in 1990. As the graph below shows, the peak was in 1991 at close to 59 million

trips before a decline set in and today the numbers are not even half that peak

at 21.5 million for 2017. These trips by Canadians to the United States were a

tourism flow into the US and a function of exchange rates, income, and

relative prices of goods.

What is also

interesting when examining travel flows is province level numbers for the

number of tourism visits, their origin, as well as the spending amounts. The figure below plots total visits to

Ontario from1998 to 2015 based on data from Ontario’s Ministry of Culture,

Tourism and Sport which in turn is based on Statistics Canada travel survey data. Total tourism visits in Ontario in 1998 were

129,646,000 and in 2015 they were 141,902,000.

The average annual growth rate of total trips was 0.6 percent - which does not seem that high. The average

annual growth rate of trips in Ontario originating from Ontario was 1.7

percent, compared to 1.1 percent from the rest of Canada, 1.6 percent for

overseas trips and -5.3 percent for the United States. Ontario has been its own best growing tourism

market accounting for 71 percent of visits in 1998 and 85 percent in 2015. The

biggest decline has been in American visitors which over the period fell from

23 percent to 8 percent.

When total spending by

these visitors is examined in the chart below, it suggests that spending has

grown faster than the number of visitors particularly for overseas visitors to

Ontario. Indeed, spending by Ontarians

visiting within Ontario grew at an annual average of 3.7 percent, that by other

Canadians 3.7 percent, Americans -1.2 percent and overseas visitors by 6.9

percent. Indeed, overseas visitors have definitely

been punching above their weight when it comes to their spending on tourism

visits to Ontario indicating that this is definitely an area where Ontario

might wish to direct its marketing activities.

Spending by overseas visitors to Ontario surpassed that of Americans in

2013 and in 2015 was 50 percent higher.

How important is this

tourism visitor spending to Ontario’s economy-approximately 2 percent of

Ontario’s GDP – but is has not changed much over the period 1998 to 2015. It has not been growing as a share of GDP

given that during this period there has been a decline in American spending

that has counteracted the rise in spending by overseas and Canadian

travelers.

When it comes to marketing tourism in northern Ontario, the above data suggests two main targets for our energy: the rest of Ontario and the overseas market. For the time being, the American market appears to have sunk into decline.

When it comes to marketing tourism in northern Ontario, the above data suggests two main targets for our energy: the rest of Ontario and the overseas market. For the time being, the American market appears to have sunk into decline.

Thursday, 8 March 2018

Cross Border Travel in Northwestern Ontario: An Update

From time to time, it is useful to review

cross-border travel statistics in northwestern Ontario at the two main border

crossings with the United States – Rainy River and Pigeon River. These travel statistics are a nice indicator of the local state of tourism as well as economic activity. Figure 1 presents monthly vehicles entering

Canada at Pigeon River from 1990 to 2017 while Figure 2 does the same for

Rainy River (Data Source: Statistics Canada). Canadian and American

vehicles are separated and a polynomial smooth is fitted to each series in an

effort to summarize trends over time.

At Rainy River, Canadian vehicles entering

have been in long-term decline while the US numbers have remained approximately

the same despite some ebbs and flows. Of

note is the bit of a dip the Canadian vehicles at Rainy River numbers have

taken since 2014 coupled with the uptick in the US numbers over the same period

– no doubt a reflection of the depreciation of the Canadian dollar in recent

years. The downturn in Canadian vehicles

coming back is even more pronounced at Pigeon River where there is a sharper

drop since 2014 while the US numbers have nevertheless registered a small

upswing. However, the overall period from 1990 to 2014 was one of general increase in Canadian vehicles coming back.

In 2014, total Canadian vehicles entering

Canada at Rainy River was 147,137 while at Pigeon River it was 230,179 compared

to 135,149 and 170,904 respectively in 2017.

From 2014 to 2017, total Canadian vehicles entering Canada at Rainy River

fell 8.1 percent while at Pigeon River the drop was 25.8 percent. Over the same

period, US vehicles entering at Rainy River went from 28,686 to 35,272 – an increase

of 23 percent – while at Pigeon River they went from 41,376 to 45,510 – an increase

of 10 percent.

Sunday, 4 March 2018

When Will the Ring of Fire Heat Up?

On Friday afternoon, I did a brief presentation at the Impact of Development Conference/Workshop held at the historic Trinity United Church on Algoma Street in Thunder Bay. My talk (which you can access here under "Looking Back and Looking Forward") was titled "Resources and the Northern and Northwestern Ontario Economies: Past, Present and Future." Along with a quick survey of the economic history of northern Ontario and an overview of current economic indicators, I also opined on the current state of developments in the Ring of Fire.

For the benefit of those not fully acquainted with the Ring of Fire, it is of course the massive planned chromite mining and smelting development project in the mineral-rich James Bay Lowland region. The area covers about 5,000 square kilometers but development has been slow. Major players include Noront Resources, the Ontario government and nine first nations. There have been a number of challenges including the cost of capital and transportation infrastructure to access the chromite, energy costs, the lengthy environmental assessment process as well as the process of consultation and negotiation with the nine members of the Matawa Tribal council. You can get a very good detailed analysis of the issues in the Skogstad-Alahmar report here.

However, all of these challenges can be resolved once the real challenge is resolved: commodity prices. Much of the hype in the Ring of Fire springs from the spike in ferro-chrome prices in the 2008-09 period which was followed by a collapse from which there has yet to be a recovery. As the accompanying figure illustrates, there was a 60 percent drop in the price of ferro-chrome and the price has not gone anywhere since.

In the end, its all about commodity prices and until the market price goes up and makes the project profitable, not much else is going to happen.

For the benefit of those not fully acquainted with the Ring of Fire, it is of course the massive planned chromite mining and smelting development project in the mineral-rich James Bay Lowland region. The area covers about 5,000 square kilometers but development has been slow. Major players include Noront Resources, the Ontario government and nine first nations. There have been a number of challenges including the cost of capital and transportation infrastructure to access the chromite, energy costs, the lengthy environmental assessment process as well as the process of consultation and negotiation with the nine members of the Matawa Tribal council. You can get a very good detailed analysis of the issues in the Skogstad-Alahmar report here.

However, all of these challenges can be resolved once the real challenge is resolved: commodity prices. Much of the hype in the Ring of Fire springs from the spike in ferro-chrome prices in the 2008-09 period which was followed by a collapse from which there has yet to be a recovery. As the accompanying figure illustrates, there was a 60 percent drop in the price of ferro-chrome and the price has not gone anywhere since.

In the end, its all about commodity prices and until the market price goes up and makes the project profitable, not much else is going to happen.